Database Update: Pharmaceutical Drug Production in Russia (October 2019)

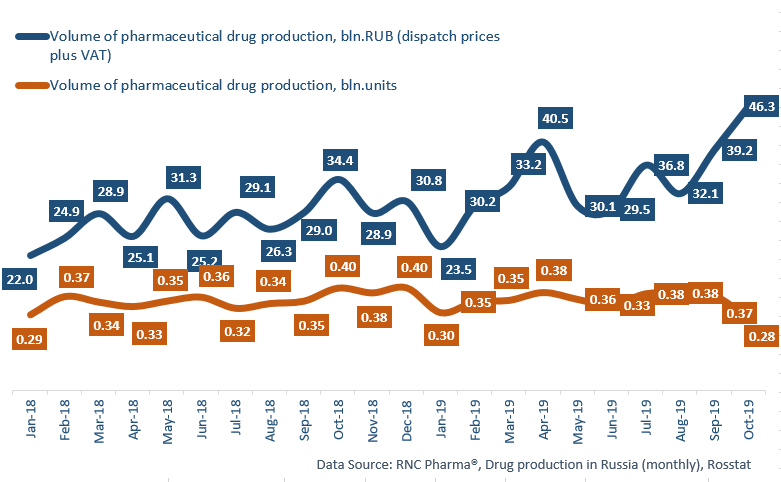

Between January and October 2019, Russia manufactured 341.3 bln RUB worth of pharmaceutical drugs (manufacturers’ prices, VAT included), which is in monetary terms (rubles) 23.6% higher than that of the same period in 2018. In physical terms, the dynamics are only +0.8% in units and +0.4% in minimum dosage units (MDU). The total production volume is 3.5 bln units and around 57.9 bln MDUs.

The low dynamics in physical terms for the period is due to the negative dynamics in physical terms in October 2019 (-29%). Drugs of prices that are lower than average were mostly the case here. While both Rx and OTC drug production decreased, the OTC drug production dropped lower.

The dynamics of the Rx drug production are +11.5% in physical terms. Ozon and Atoll are the leaders here, they account for 13.2% of the total Rx drug production, with the dynamics of +37% and 27%. Among the top 20 Rx drug manufacturers, Gedeon Richter has the highest dynamics, with +65%. Verospiron and Ekvapress contributed to the dynamics with 4.7 and 3.6 times increases, respectively. Gedeon Richter is followed by Kraspharma. Antibiotics Cefazolin and Imipenem + Cilastatin contributed to the dynamics with 5.7 and 4.2 times increases.

As for the OTC drug production, the dynamics are -5.8% in physical terms. The leader Pharmstandard accounts for 18.9% of the total production volume, with the dynamics of +3%. Among the top 20 manufacturers, Ivanovo Pharmaceutical Plant has the highest dynamics, with +30%. The production of the drug for eczema and hyperhidrosis Halmanin has increased by 14.8 times. The production of traditional drugs, such as Sodium Tetraborate and Ammonia, has also increased a lot (5.2 and 2.8 times increases). Ivanovo Pharmaceutical Plant is followed by Samaramedprom, with the dynamics of +28%. The production of its Pertussinum has increased by 10.6 times.

Read more about pharmaceutical drug production in Russia (September 2019) here: http://rncph.com/news/29_10_2019

Dynamics of pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (units) and monetary terms (RUB, VAT included) (January 2018 – October 2019)

Рус

Рус