Database Update: Audit of Veterinary Drug Retail Sales in Russia (September and Q1–Q3 2022)

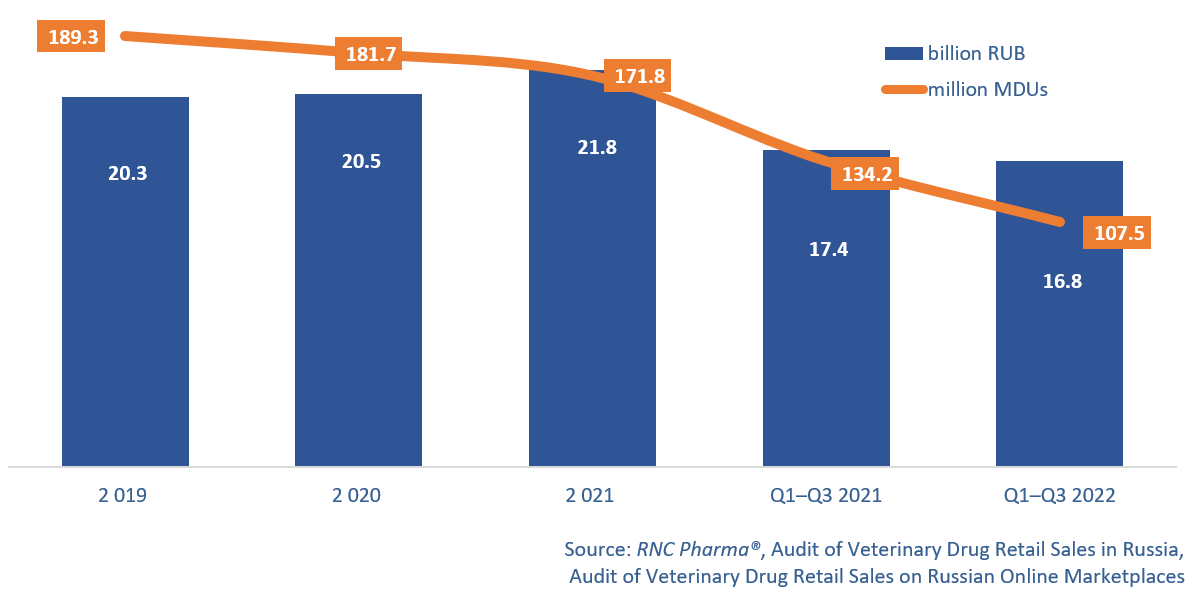

In Q1–Q3 2022, the sales of veterinary drugs in the Russian retail market were 16.8 billion RUB (retail prices, VAT included), down 3.6% from Q1–Q3 2021. Even the actively growing e-commerce with its growth rates of 67% could not save the situation. In physical terms, the sales were 107.5 million minimum dosage units (MDU), down 20%. The online sales went up 33%, while the offline sales fell 21%.

Q3 2022 was more or less the same as the first nine months of 2022: the growth of the online channel failed to compensate for the decline of the offline. The growth rates in Q3 2022 were –12% in monetary and –24% in physical terms. Several factors obviously affected the consumer behavior: from the rush demand in early 2022 to the weather anomalies in summer and decreasing household incomes.

Despite the falling demand, the market continued to develop gradually. In particular, the product range grew by 32 brands—to 1,255 in January–September 2022. The number of drug forms increased even more—from 3,346 in Q1–Q3 2021 to 3,425 in Q1–Q3 2022.

Insectoacaride Racidol from Rubikon (Belarus) had the best growth rates—its sales grew 317 times against January–September 2021. The second place is another Belarusian drug, Averon by Belekotechnika, an antidote and hepatoprotector for pets and farm animals. Its sales grew 155 times against Q1–Q3 2021. However, both drugs were not among the best-selling drugs. Among the top 100, the sales of antimicrobial Otoxolan by KRKA increased 4.7 times against Q1–Q3 2021.

In physical terms, the sedative drug for both pets and livestock Myoxyl by Novaya Gruppa had the best growth rates—its sales increased 763 times against January–September 2021. Myoxyl is followed by the antibacterial drug for farm animals Coliflox-Pharmum by Alpovet (Cyprus)—its sales grew 65.4 times. As for the best-selling products, Metronidazole by Askont+ (Russia) had the highest growth rates (4.8 times against Q1–Q3 2021).

The volume of the Russian veterinary drug retail market (online sales included) in monetary (RUB, end-user prices, VAT included) and physical terms (MDUs) (2019–2021, Q1–Q3 2022)

Рус

Рус