Pharmaceutical Drug Import to Russia (March 2019)

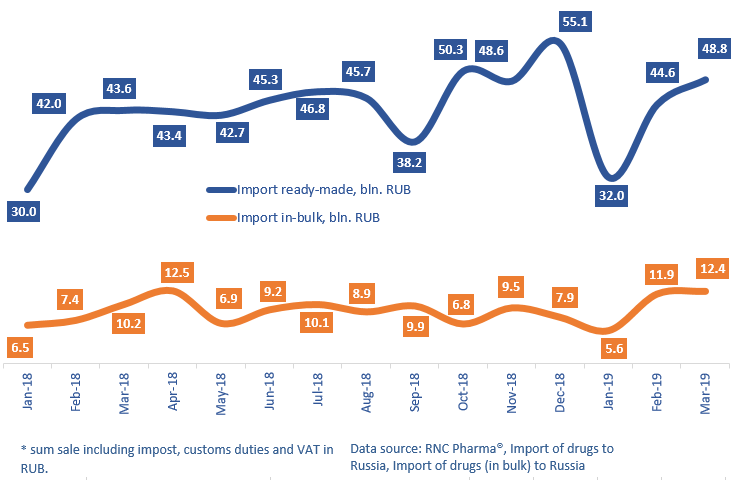

Between January and March 2019, Russia imported 125.5 bln RUB worth of ready-made pharmaceutical drugs (free circulation prices), which is in monetary terms (rubles) 8.5% higher than that of the same period in 2018, and 30 bln RUB worth of in-bulk drugs, which is in monetary terms 24.4% higher than that of the same period in 2018. The total dynamics are +11.3% for the period.

However, the dynamics in physical terms are not even positive. Between January and March 2019, Russia imported 406.8 mln units of ready-made drugs, which is 9.2% lower than that of the same period in 2018. The dynamics of the in-bulk import in physical terms are -33.6%, if calculated in minimum dosage units (MDU). The total dynamics in physical terms are -12.6%. That speaks of import substitution, and the process of import substitution slowed down in 2018. For comparison, the dynamics of pharmaceutical production in Russia are +0.5% in units and +1.2% in MDUs.

Among the top 15 companies with the biggest ready-made drug import, Astellas and Alexion have the highest dynamics in monetary terms with a 2.3 and 2 times increase, respectively. Astellas increased their dynamics mainly by import of Flemoxin Solutab and Advagraf, which were not imported to Russia between January and March 2018, while Alexion increased their dynamics by import of Soliris.

As for in-bulk drug importers, Roche is the absolute leader with an 8.2 times increase. Out of 19 trademarks that Russia imported between January and March 2019, 7 were in-bulk. However, since these drugs had been imported earlier as well, that is not the result of wider localization but different import frequency. The company’s local partners are still R-Pharm and Pharmastandard.

Read more about pharmaceutical drug import to Russia (February 2019) here: http://www.rncph.com/news/15_04_2019_1

Dynamics of import of pharmaceuticals, including homeopathic and seawater drugs, to Russia, free circulation prices including customs clearance and VAT, RUB (January 2018 – March 2019)

Рус

Рус