RNC Pharma: More Than 6M Blood Pressure Monitors Sold in Russia in 2023, Up 29%

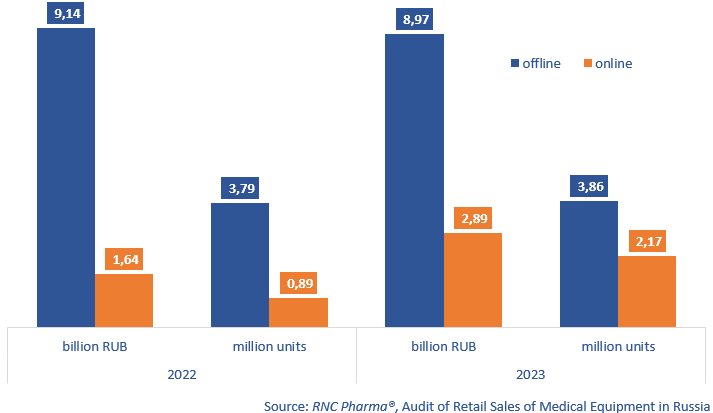

In 2023, around 6.03 million of all types of blood pressure monitors worth 11.87 billion rubles (retail prices, VAT included) were sold in the offline and online retail market in Russia. The sales went up 29% in physical terms and up 10% in monetary terms. This difference is associated with the average price dropping by nearly 15%, which is mainly due to large online retailers that sell unbranded products experimenting with their product range. Less known products accounted for 56% of the sales in physical terms in 2023 against 31% back in 2022. However, the old dumping strategy, which proved to be effective, was also used.

The total online sales of blood pressure monitors in 2023 in physical terms increased 2.4 times against 2022; the sales in monetary terms grew by only 77%. While monitors of less known brands contributed to the growth rates the most, the online sales of popular brands also saw a noticeable increase, albeit more modest: the sales went up 56% in physical and up 43% in monetary terms. The online sales accounted for 36% of the total sales in 2023 in physical (against 19% in 2022) and for around 24% in monetary terms (against 15% in 2022).

The offline sales of blood pressure monitors in physical terms grew 2.1%. However, with the average price going down 4%, the sales fell 2% in monetary terms. In general, offline retailers of blood pressure monitors have not lost much so far; online retailers did not try to poach customers from pharmacy chains and non-pharmaceutical retailers last year, opting for development instead. They attracted new consumers, offering them cheaper products of less known brands. Still, this seems to be only the beginning, especially since those customers who buy other types of home medical equipment have long gotten used to online shopping, where they shop mainly brands.

Japanese A&D accounted for 29.2% of the sales in monetary and for around 25.1% in physical terms in 2023. At the same time, the company’s sales went up only 5% from 2022 in monetary terms and up 16% in physical terms. The sales of UA-888 contributed to the growth rates the most. A&D is followed by Omron with its 28.6% in monetary terms. In physical terms, however, unbranded monitors took second place with 20.8%; Omron took third place.

Shenzhen Jamr Technology had the best growth rates in both monetary and physical terms; its sales increased 11.5 times against 2022 in rubles and 14.1 times in units. The company’s products are sold in Russia under the brand SberZdorovye; however, they sell only around 5,600 monitors a year. As for larger companies that sell more than 100,000 monitors a year, the sales of Microlife went up 13% in rubles and 12% in units. BP 3AG1 contributed to the company’s growth rates the most.

Fig. 1. Sales of blood pressure monitors in the Russian retail market in monetary (rubles, retail prices, VAT included) and physical terms (units)

Рус

Рус