API Import to Russia (November 2022)

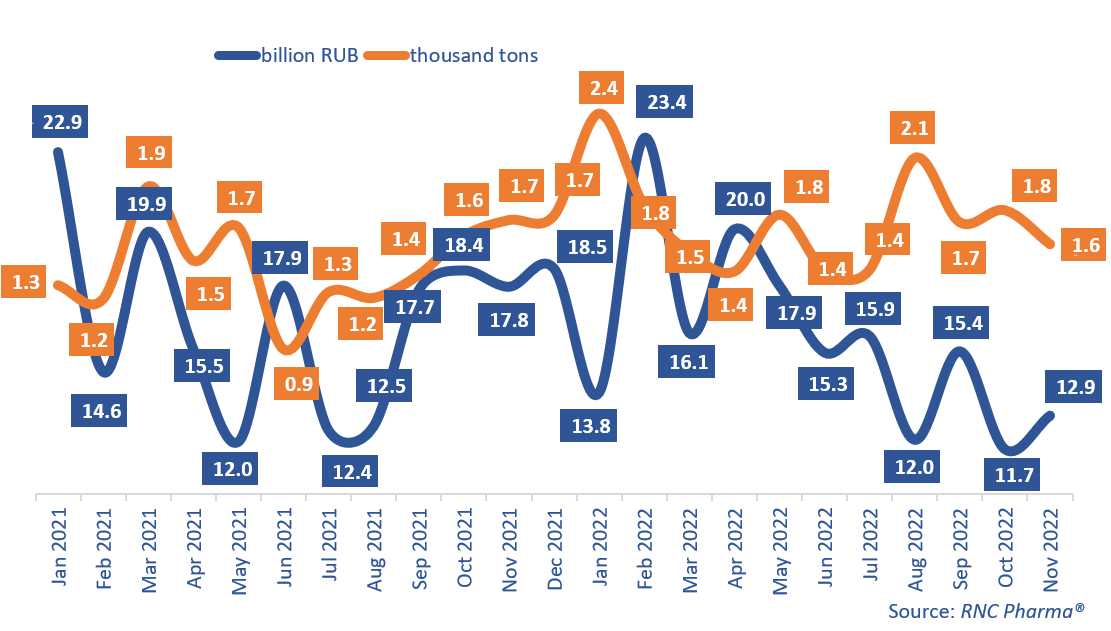

In January–November 2022, Russia imported 174.5 billion rubles’ worth of APIs (customs clearance and VAT included), down 3.9% from January–November 2021. In physical terms (tons), the growth rate was 19.8%, with 18,900 tons imported. In November 2022, Russia imported 12.9 billion rubles’ worth of APIs, down as much as 27% from November 2021. In physical terms, the import also decreased (by 9%)—for the third time this year since spring, when March and April saw a severe crisis in terms of logistics. Now, the decrease is likely due to low activity in the market, as well as the fact that Russian importers stocked up on APIs back when the Russian ruble was still strong. The ruble took a drastic turn in December, which is sure to have affected the import in monetary terms in December 2022.

The INNs of imported APIs grew in number—from 663 in January–November 2021 to 706 in January–November 2022. Interestingly, Russia started importing 51 INNs that had not been imported outside the EEU to Russia since 2010. Calcium phosphate, imported from China for Pharmstandard-Ufavita, accounted for the largest volumes among those “newbies.” (Technically an API, it is more often used as a pharmaceutical aid.) A large volume of ethanol was imported from South Ossetia for Farmmed (Vladikavkaz). Sevelamer, imported from India for PSK Pharma (Dubna, Moscow Oblast), rounds out the top three.

Rivaroxaban had the best growth rates in physical terms in January–November 2022—its imports went up 31,000 times against January–November 2021. However, that is a direct result of the so-called “low base”, since only a few grams of the API were imported last year. China accounted for the import of the largest volumes, and Nizhpharm and Beryozovsky Pharmaceutical Plant bought the largest amounts. Rivaroxaban is followed by meldonium, imported from China for NPF Kem—its imports grew more than 1,200 times against January–November 2021.

In monetary terms, apart from those mentioned, the import of molnupiravir increased 483 times against January–November 2021. It was imported from China and India for Promomed and Obninsk Chemical and Pharmaceutical Company, respectively. The import of tizanidine, bought by Novartis-Neva, went up 232 times. This is one of the few examples when foreign manufacturers, localized in Russia, import APIs directly from China.

Growth rates of pharmacopoeial and commercial API imports to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT (January 2021–November 2022)

* The current and historical data on the API import into Russia were updated with data on the import of APIs categorized as FEACN Group 28: products of inorganic chemistry; inorganic or organic compounds of precious metals, rare-earth metals, radioactive elements or isotopes. As a result, the total import of API went up 0.4% in monetary and 4.5% in physical terms against the previously reported data.

Рус

Рус