Import of Veterinary Drugs and Feed Supplements to Russia (October 2022)

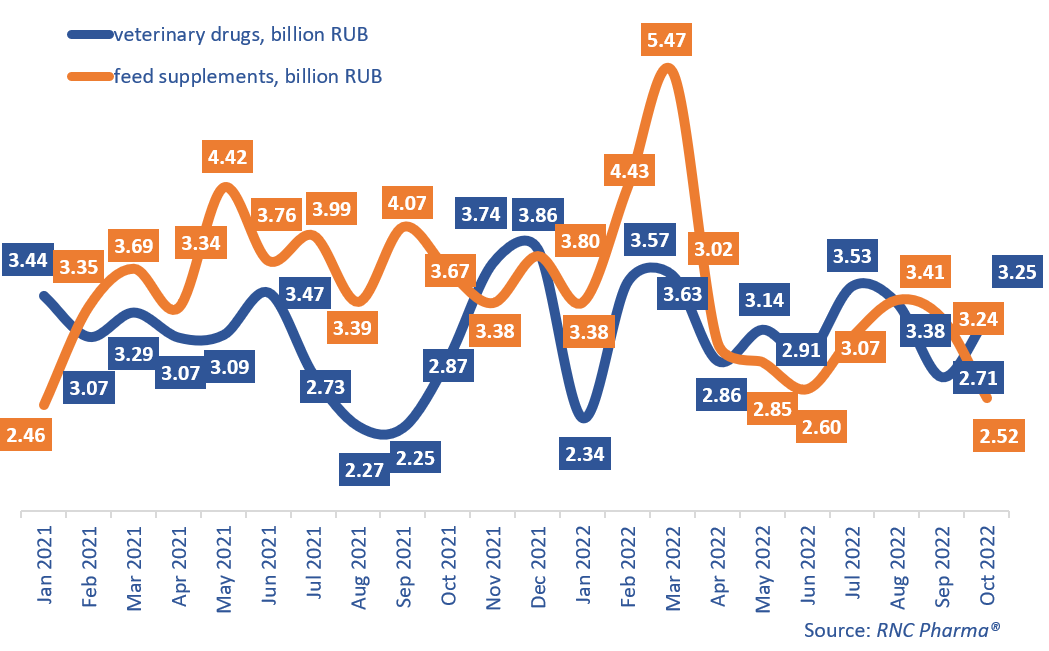

From January to October 2022, Russia imported 31.4 billion rubles’ worth of veterinary drugs (customs clearance and VAT included), up 5.9% from the same period in 2021. In physical terms, the import grew 7.4%, with more than 27.4 million packages imported. As for feed supplements, the import fell 5.9%, with almost 34 billion rubles’ worth of products. In physical terms, the import, 120,100 tons, went down 14% from January–October 2021.

October 2022 followed this year’s trends—imports of veterinary drugs went up 13% (3.25 billion rubles), or 11% in physical terms (3.2 million packages). Imports of feed supplements fell to a 20-month low, 2.5 billion rubles (down 31%). In physical terms, the growth rate was a bit better—the import declined by 25%, with 10,900 tons imported.

The number of brands of imported veterinary drugs in January–October 2022 was 517, down by as many as 110 names from the same period in 2021. The number of importers fell as well—from 103 in January–October 2021 to 90 in January–October 2022.

KRKA had the best growth rates in physical terms, and its direct imports increased 2.3 times against January–October 2021. The company imported 21 brands of veterinary drugs, with Milprazon and Selafort contributing to the growth rates the most. In monetary terms, Zoovet Productos Veterinarios (Argentina) had the highest growth rates—the company’s imports went up 11.6 times against the comparison period, with Cefafur and Ziflor, combined antibiotics with NSAIDs for livestock, contributing to the growth rates the best.

As for feed supplements, the number of brands went down 180 names—to 445 in January–October 2022. The number of importing companies was 197, down 51 from January–October 2021. Shandong NHU Amino Acid (China) had the best growth rates in physical terms, importing only one product, Sandimet DL-methionine. The company also came in second in terms of direct imports, which grew 16.7 times against the comparison period. Another Shandong manufacturer came in first, Aocter Chemical—its imports of Choline Chloride went up 22.7 against January–October 2022. Another Chinese company, FNF Ingredients, multiplied its imports as well—they grew 13 times against the comparison period. Its Betaine Hydrochloride contributed to the company’s growth rates.

Growth rates of the import of veterinary drugs and feed supplements to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT (January 2021–October 2022)

Рус

Рус