Ranking of Russian Pharmaceutical Distributors (Q1–Q3 2021)

The Russian State Duma of the 8th convocation intends to continue working on the draft law that introduces restrictions for the pharmaceutical retail market and wholesale companies. At the same time, it is willing to revise certain provisions, including the maximum amount of marketing bonuses. While it may seem industry-specific, both the stability of the Russian pharmaceutical retail and the pricing policy at all stages of the movement of goods directly depend on that provision.

The pharmaceutical market is experiencing a significant price increase for the second year in a row, and the number of the factors influencing the increase is large enough as it is. In addition, the inflation factor was the one that practically shaped this year’s growth rates of the Russian pharmaceutical market. If not for the larger funding in the public sector, the growth rates would be much worse. All that could explain the responses of the market participants. First, the industry seems to have moved from the stage of “denial” to “bargaining”, with the Russian Association of Pharmacy Chains stating their intention to actively lobby for the proposal to radically expand the range of drugs allowed for sale in pharmacies. This may be the only way to counterbalance the situation if marketing budgets are actually severely limited by the new law, since it would help improve the front margin without any significant price increase.

For wholesalers, it would not only be an opportunity to increase revenue by selling additional assortment, but also an important stabilizing factor that protects the retail market from massive bankruptcies and minimizes financial losses.

The new measure would also help the offline retail, as well as distribution companies’ online projects in their competition with actively developing marketplaces, which will inevitably take away consumers from the pharmaceutical retail due to a wider assortment, among other things.

Another strategy includes a simple scaling of activities. Larger pharmaceutical distributors working with the retail have been actively increasing their customer base since 2020, when the total number of shipping points for the top 3 Russian pharmaceutical distributors increased by 10.5% (against 1.5-2% at best in the previous years). All that occurred despite the fact that several companies had cleaned up their customer bases.

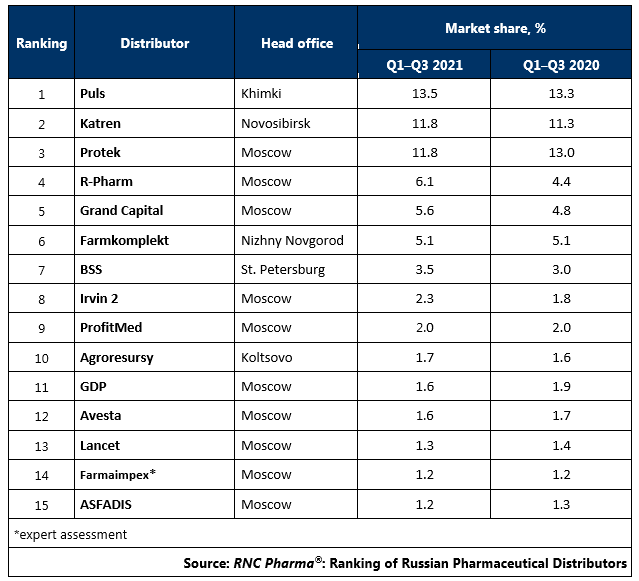

Tab. Top 15 pharmaceutical distributors with the largest market shares of direct pharmaceutical drug shipments (including preferential and regional shipments), in monetary terms (Q1–Q3 2021)

Рус

Рус