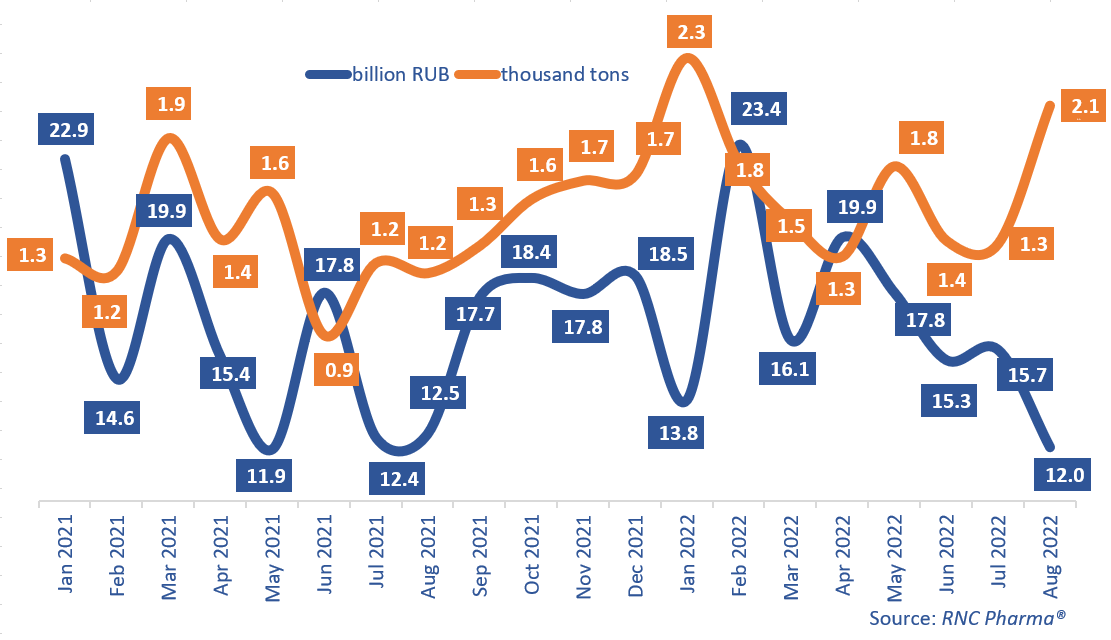

Pharmaceutical Drug Import to Russia (August 2022)

In January–August 2022, Russia imported 535.5 billion rubles’ worth of ready-made pharmaceutical drugs (customs clearance and VAT included), up 9.4% from the same period in 2021. It was mainly the work in August that helped maintain positive growth rates. As for bulk drugs, the growth rate was 23.4%. In physical terms, the growth rates for both groups were negative. The import volume of ready-made drugs was around 1.1 billion packages, down 7.7% from January–August 2021. The import of bulk drugs was 983 million MDUs, down 34.6%.

In August 2022, Russia imported 76.2 billion rubles’ worth of ready-made drugs, up 35.4% from August 2021, which is the best growth rate since January 2022, when it was 34.7%. In physical terms, the growth rate was at an eight-month-high, 21%. As for bulk drugs, it was 11.4%, with 17 billion rubles’ worth of drugs imported. While not the worst result, it is still half or even one-third the growth rates seen in previous months. In physical terms, the growth rate was at an eight-month-low, –53% in MDUs.

Vertex Pharmaceutical and Sarepta Therapeutics, producers of orphan drugs mentioned several times in our previous analyses, had the best growth rates in January–August 2022 among the manufacturers of ready-made drugs. Imports by the companies grew 12.9 and 64.7 times against January–August 2021, respectively. Biocodex (France) increased its imports 4.9 times against January–August 2021. The manufacturer imported six medicines, with the probiotic Enterol and Otipax ear drops contributing to the growth rates the most. Another manufacturer of orphan drugs, PTC Therapeutics (USA), had comparable growth rates, having increased imports 4.8 times against January–August 2021. It imported only Translarna, a medicine used to treat Duchenne muscular dystrophy.

As for manufacturers of bulk drugs, CSL Behring once again had the best growth rates—the company increased its imports 4.6 times against January–August 2021. Astellas Pharma (Japan) and Eli Lilly (USA) also had high growth rates—imports grew 2.8 and 2.6 times against January–August 2021, respectively. Flemoxin Solutab, packaged at Ortat of R-Pharm in Russia, contributed to Astellas Pharma’s growth rates the most. The import of antitumor Cyramza, packaged at a Pharmstandard enterprise in Ufa, helped the growth rates of the American company.

Growth rates of pharmaceutical imports to Russia (EEU countries excluded), free circulation prices, customs clearance and VAT included, RUB (January 2021–August 2022)

Рус

Рус