Database Update: Import of Veterinary Drugs, Feed Supplements and APIs to Russia (March 2018)

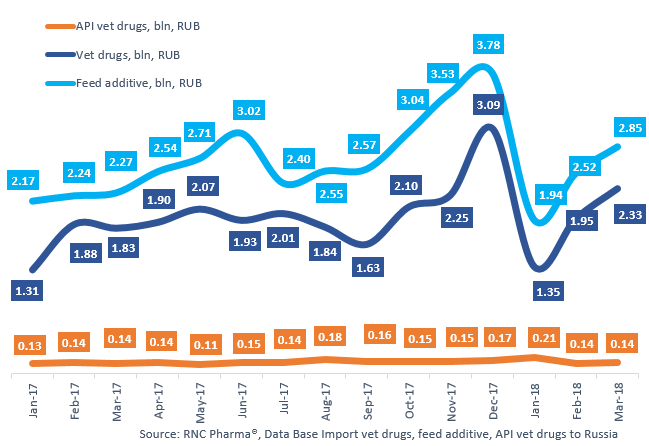

Between January and March 2018, Russia imported 13.4 bln RUB worth of veterinary products, with 7.3 bln RUB for feed supplements (9.4% increase in monetary terms), 5.6 bln RUB for veterinary drugs (12% increase), and 0.48 bln RUB for veterinary APIs (20% increase.)

In physical terms, the dynamics are much worse, with -10% for veterinary drugs, -22% for feed supplements, and -13% for veterinary APIs. March followed the trends of the previous months; the dynamics in physical terms are also negative.

As for the manufacturing countries, South Korea (Daesung) has increased its import of feed supplements in monetary terms by 5.1 times. Vietnam (Vemedim Corporation) has increased its import of veterinary drugs by more than 21 times. While the leader in the dynamics of the import of veterinary APIs is Bulgaria (Huvepharma), it has increased the import by 2.3 times.

Dynamics of import of veterinary drugs, feed supplements, and veterinary APIs to Russia, free circulation prices including customs clearance, bln RUB (January 2017 – March 2018)

Рус

Рус