Pharmaceutical Drug Production in Russia (February 2023)

pharmaceutical drugs (manufacturer’s prices, VAT included), down 12.6% from February 2022. In physical terms, the manufacture went down 6.2%, with 607.9 million packages produced. In minimum dosage units (MDU), however, the manufacture increased 0.6% from February 2022, with 11.9 billion MDUs manufactured.

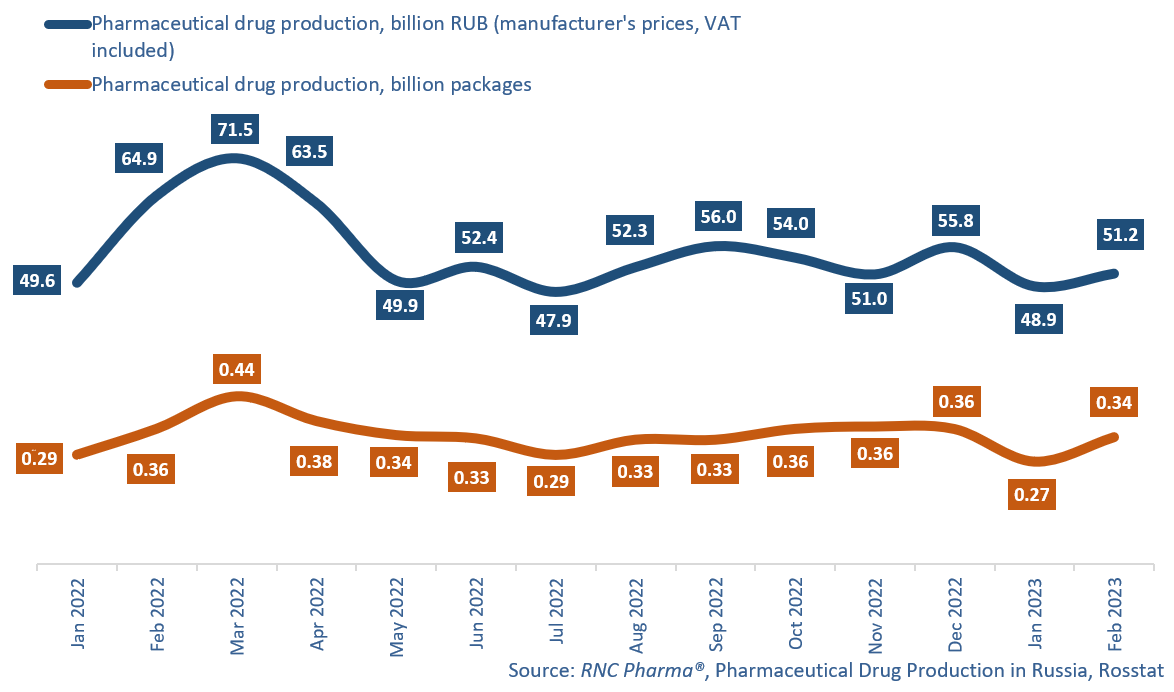

Manufacturers of pharmaceutical drugs followed the January trends, producing 51.2 billion rubles’ worth of ready-made drugs in February 2023, down 21.2% from February 2022, or 335.9 million packages, down 6.2%. In MDUs, the growth rate was 4.1%, with 6.7 billion MDUs manufactured.

The number of manufacturing companies in January–February 2023 was 326, up 18 from January–February 2022. The assortment also grew significantly, mainly thanks to prescription drugs—from 986 in 2022 to 1,053 INNs in 2023, and from 1,569 in 2022 to 1,694 brands in 2023.

Despite the active development of the assortment, the production of both prescription and OTC drugs decreased in physical terms—down 4.2% and 7.7%, respectively. The manufacture of drugs containing quetiapine had the best growth rates among the top 50 Rx drugs in January–February 2023—it grew 16.6 times against January–February 2022. Interestingly, the number of manufacturers here doubled (from 3 to 6), with Severnaya Zvezda contributing to the growth rates the most. Carbamazepine, manufactured by 3 companies at once, comes second—its production went up 7 times against January–February 2022, and Alsi Pharma and Binnopharm contributed to the growth rates the best. Oseltamivir rounds out the top three—its manufacture grew 4.6 times against January–February 2022. The drug was produced by 7 manufacturers, with Pharmasyntez helping the growth rates the most. As for the highest growth rates outside the top 50, the production of levodopa + carbidopa (as Nakom by Novartis) grew more than 3,600 times against January–February 2022.

Among the top 50 OTC drugs, the manufacture of naphazoline increased 7 times against January–February 2022. Despite the high growth rates, the number of manufacturers decreased from 9 to 8, with Slavyanskaya Apteka and DAV Farm accounting for the best growth rates. Naphazoline is followed by magnesium and potassium aspartate (production increased 4 times), manufactured by 4 companies. Renewal contributed to the growth rates the best. Rimantadine manufacturers (8 companies) round out the top three (manufacture grew 3.8 times), with Usolpharm contributing to the growth rates the most. The production of acetylsalicylic + ascorbic acid by Renewal had the best growth rates—it went up 43.5 times against January–February 2022.

Pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (packages) and monetary terms (RUB, VAT included) (January 2022–February 2023)

Рус

Рус