Pharmaceutical Drug Production in Russia (November 2022)

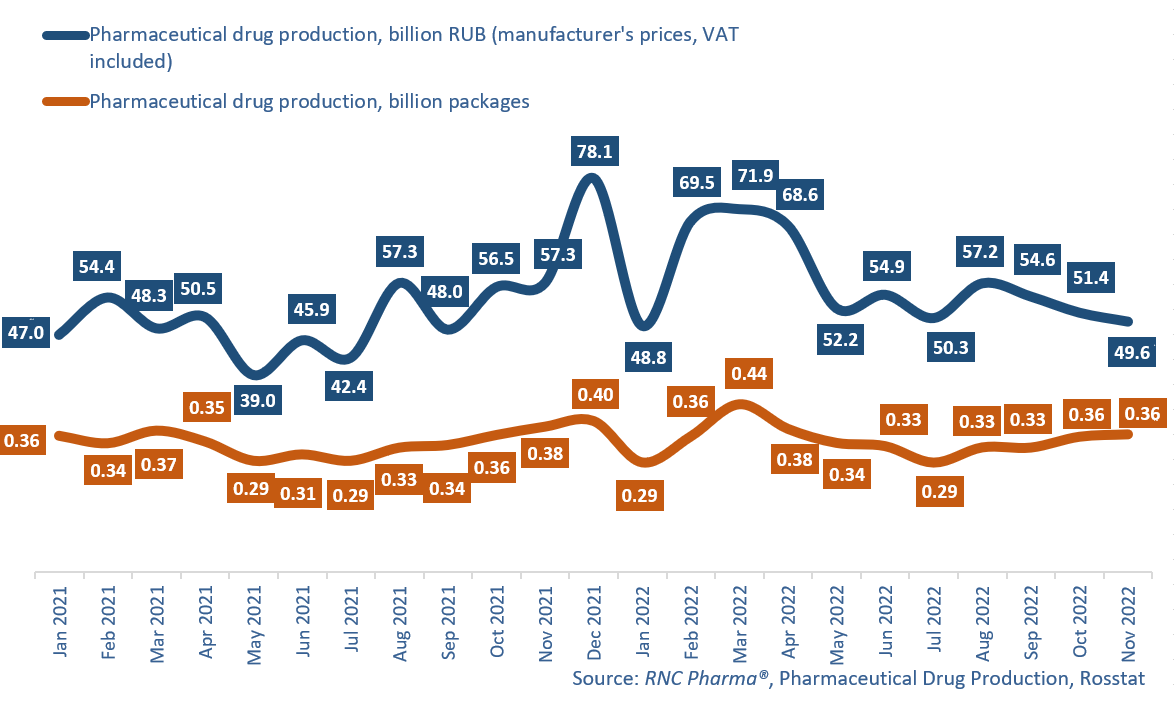

In January–November 2022, Russian manufacturers produced 629.1 billion rubles’ worth of ready-made drugs (manufacturer’s prices, VAT included), up 15.1% from the same period in 2021. In physical terms, the production volume was 3.81 billion packages, up 2.2% from January–November 2021. If calculated in minimum dosage units (MDU), 72.5 billion MDUs were produced, up 2.3% from the same period last year. In November 2022, pharmaceutical companies followed the trends the pharmaceutical industry has been keeping up with since July 2022. In physical terms, 363.6 million packages of ready-made drugs were produced, down 5.2% from November 2021, which is the second worst growth rate this year (after January 2022). If calculated in MDUs, the production volume was 6.92 billion, up 2.2% from November 2021. In monetary terms, 49.6 billion rubles’ worth of pharmaceuticals was manufactured, down 13.4%—the base effect from November 2021, when the manufacture of coronavirus vaccines together with other covid-related medicines was at its peak.

The product portfolio of pharmaceutical manufacturers localized in Russia had 1,413 INNs in January–November 2022, up 80 from January–November 2021, and 2,750 brands, up 159. At the same time, manufacturers of OTC drugs were head and shoulders above manufacturers of prescription drugs in terms of growth rates. The production of OTC drugs increased 9% from January–November 2021, while that of Rx drugs decreased 4.9%. However, the manufacture of only 44 OTC drugs multiplied, in particular the following INNs: rauwolfia alkaloids (antihypertensive Raunatine by Vifitekh (Moscow); manufacture grew 12.1 times against January–November 2021), polyvinox (Vinylin, manufactured by five companies at once, with Usolpharm and Tula Pharmaceutical Factory contributing to the growth rates the most; production grew 6.6 times), and estriol (Orniona by Vertex; manufacture went up 4.5 times).

As for prescription drugs, there were much more examples of multiple growth in manufacture compared to the OTC category. Despite the overall negative growth rates, the production of around 130 INNs multiplied. A vaccine for the prevention of meningococcal infections and nefopam had the best growth rates: the production of the former grew 13.2 times in packages against January–November 2021, while that of the latter 11.3 times. The increased production of the vaccine was due to the start of its localization at the facilities of Nanolek in Kirov Obslast—now the company is responsible for secondary packaging. Nefopam was produced by three companies at once, with Endokrinnye Tekhnologii contributing to the growth rates the most. The increased demand for nefopam is obviously associated with the special military operation and, most importantly, the start of partial mobilization, since the production peaked in October and November 2022.

Pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (packages) and monetary terms (RUB, VAT included) (January 2021–November 2022)

Рус

Рус