Pharmaceutical Drug Import to Russia (October 2022)

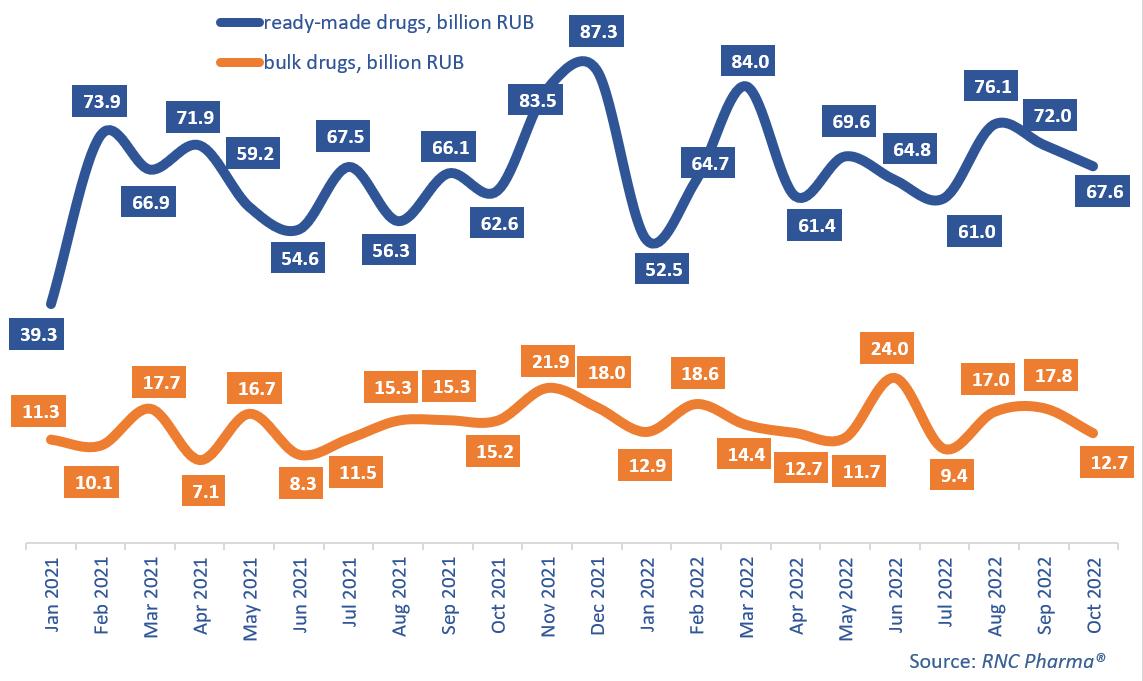

In January–October 2022, Russia imported 673.8 billion rubles’ worth of ready-made pharmaceutical drugs (customs clearance and VAT included), up 9% from the same period in 2021. As for bulk drugs, the import was 151.3 billion rubles, up 17.7%. In physical terms, the import of both groups decreased—ready-made drugs went down 8.6%, with 1.36 billion packages imported, and bulk drugs went down 30%, with 1.29 billion minimum dosage units (MDU).

In October 2022, the growth rate of the import of ready-made pharmaceuticals was average, 8%, with 67.6 billion rubles’ worth of drugs imported. As for bulk drugs, the import actually decreased 17% in October, after it had been growing for two months in a row. In physical terms, the import of ready-made drugs fell 20% and that of bulk drugs went up 57%.

As a result of the optimization of product portfolios, as well as localization, the number of brands of ready-made drugs imported to Russia in January–October 2022 was 2,126 names, down 39. Notably, the number of importers even increased by two, from 286 in January–October 2021 to 288 this year. As usual, importers of medicines for orphan diseases had the best growth rates in monetary terms, in particular, imports by Y-mAbs Therapeutics (USA) grew nearly 36 times against January–October 2021. The company imported only Danyelza, a drug for neuroblastoma. However, a few importers of drugs for less serious diseases also had high growth rates, including ALK-Abello (Denmark)—its imports of three types of allergens for AIT went up 1.7 times against January–October 2021. The import of Ragvizax increased the most.

The number of brands of imported bulk drugs was 206 in January–October 2022, down 24 names. Yet, the number of importers stayed practically the same, 63 against 64 in January–October 2021. Stada had the best growth rates—its imports of two drugs increased 5 times against the comparison period, with Edarbi, a drug for essential hypertension, contributing to the growth rates the most. Imports by Gedeon Richter grew 2.3 times against January–October 2021. The company’s portfolio was noticeably wider—eight brands; another drug for hypertension, Ekvator, helped the growth rates.

Growth rates of pharmaceutical imports to Russia (EEU countries excluded), free circulation prices, customs clearance and VAT included, RUB (January 2021–October 2022)

Рус

Рус