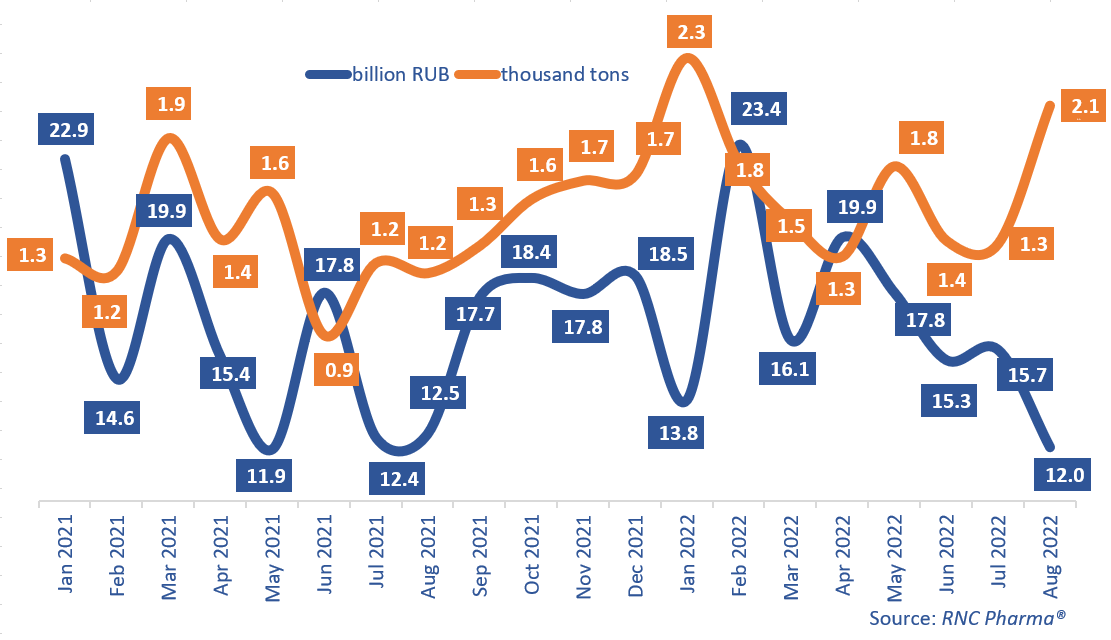

API Import to Russia (August 2022)

In January–August 2022, Russia imported 134.1 billion rubles’ worth of APIs (customs clearance and VAT included), up only 5.2% from January–August 2021. In physical terms, the growth rate was as high as 25.3%, with 13,400 tons imported. The August results reflected the general trends: API imports went down 4% in monetary terms from August 2021, with 12 billion rubles’ worth of APIs imported. In physical terms, the growth rate was 73%, with 2,100 tons imported. The INNs of imported APIs grew in number—from 266 in August 2021 to 323 in August 2022. However, the growth rate in monetary terms differed that much from that in physical terms mostly due to deflation in the market, with the Laspeyres price index of –20.6%.

The number of APIs imported in January–August 2022 went up as well—from 611 to 644. Among the top 20 INNs of APIs with the largest import volumes in monetary terms, 14 had positive growth rates. The import of osimertinib had the highest growth rates, having grown 3.5 times against January–August 2021. AstraZeneca Industries bought the largest volumes for the production of the antitumor drug Tagrisso in Kaluga Oblast. BratskChemSyntez, a Pharmasyntez Group enterprise, also imported a small amount of this commercial API. Osimertinib is followed by deproteinized hemoderivative of calf blood; its imports (by Takeda) increased 2.1 times against January–August 2021.

As for the top INNs with the largest imports in physical terms, 13 had positive growth rates. The import of lactulose had the best growth rates; it grew 26.7 times against January–August 2021. Veropharm imported the largest volumes for the production of Duphalac in Belgorod. Lactulose was also imported by AVVA Rus in small volumes, although those imports went down compared to last year. The imports of dextrose increased 2.8 times against January–August 2021. It was imported by 15 companies at once, with Protek-SVM and Imcopharma accounting for the largest volumes. The import of caffeine also grew 2.8 times. Pharmstandard was the main buyer, contributing to the growth rates the most.

Growth rates of pharmacopoeial and commercial API imports to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT (January 2021–August 2022)

Рус

Рус