Pharmaceutical Drug Production in Russia (March 2021)

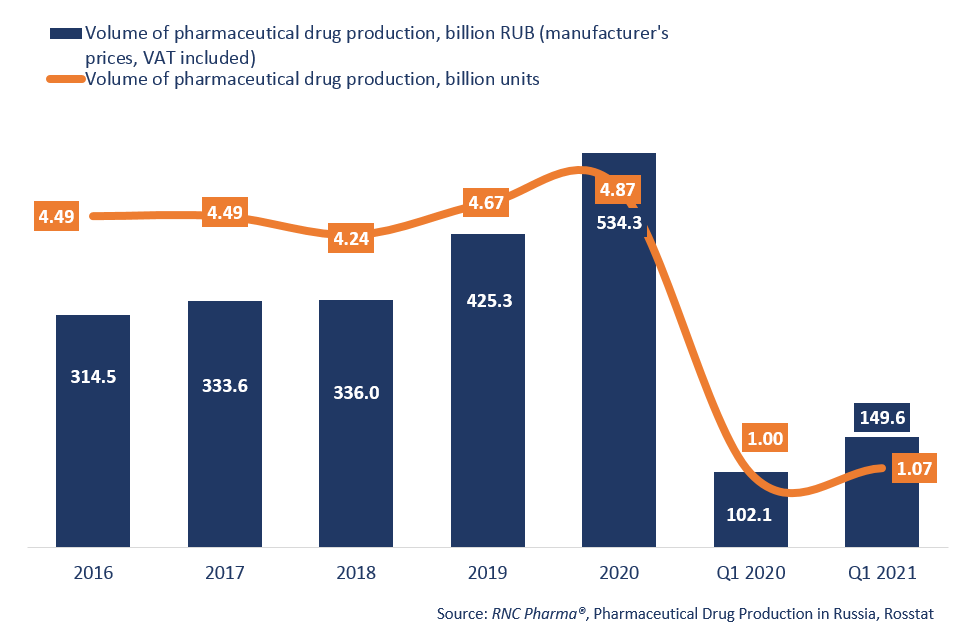

Russian manufacturers produced 149.6 billion rubles worth of pharmaceutical drugs between January and March 2021 (manufacturer’s prices, VAT included), up 47% from the same period last year in monetary terms (rubles). While it is early to make predictions, it has been the highest growth rate in five years. The growth rate in physical terms (units) was +7%, with the production volume of 1.07 billion units. The growth rate was even lower, if calculated in MDUs (minimum dosage units), reaching 4.2%, with the production volume of 19.4 billion MDUs.

The growth rates in Q1 varied from region to region. In particular, the Central Federal District manufactured the highest volume—82.5 billion rubles worth of pharmaceuticals, which is 55% of the total production volume in Russia. The Volga Federal District came second, having produced 25.1 billion rubles worth of pharmaceuticals—about 17% of the total volume. The growth rates of the production in monetary terms were +55% for the Central Federal District and only +19% for the Volga Federal District. Pharmaceutical companies in the Ural Federal District had the best growth rates of +93%, and the federal district’s manufacture accounted for nearly 10% of the total production volume in the country. While the growth rates of the OTC production in January–February 2021 lagged behind those of the Rx production, the growth rates were still double-digit. However, the situation returned to its usual course by March, with the Rx production up 17% and the OTC production down 1% in physical terms (units) from March 2020.

Tula Pharmaceutical Factory had the highest growth rates among the top 20 manufacturers of Rx drugs. The company’s manufacture increased 8.7 times in physical terms. Only the production of powder for preparation of oral solution Magnesium Sulfate, in fact, contributed to the company’s growth rates out of the five trade names produced. Tula Pharmaceutical Factory is followed by Merck Group, which increased its manufacture 2.8 times. The company produced drugs of only three trade names, and the manufacture of Concor and Glucophage had the biggest growth rates, having increased 2.9 and 3 times, respectively. Since Merck Group does not have its own production capacities in Russia yet, both drugs are produced at the contract plant Nanolek in the Kirov Region.

As for the manufacturers of OTC drugs, Firn-M increased its production 5.2 times, with its hit Grippferon contributing to the growth rate. Valenta came second; the company’s production grew up 4.6 times. It’s Ingavirin contributed to the growth rate the most—with its manufacture tripling, the drug accounted for nearly 60% of the total production by the company. However, it was Trimedat and Grammidin that had the best growth rates; the manufacture grew up 46 and 30 times, respectively.

Volumes of pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (units) and monetary terms (RUB, VAT included) (2016 – 2020, Q1 2021)

Рус

Рус