Import of Veterinary Drugs and Feed Supplements to Russia (September and Q1–Q3 2022)

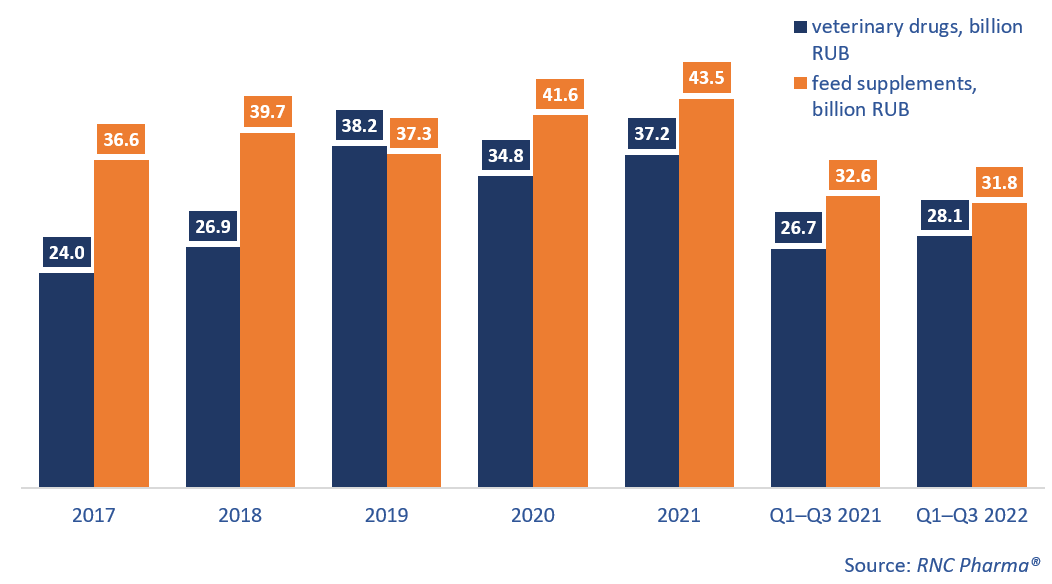

From January to September 2022, Russia imported 28.1 billion rubles’ worth of veterinary drugs (customs clearance and VAT included), 5.1% up from the same period last year. In physical terms, the growth rate was 7.6%, with 24.4 million packages imported. As for feed supplements, the growth rates in both monetary and physical terms are negative: –2.3% in rubles and –12.1% in tons. The import of feed supplements in January–September was 110,300 tons worth around 31.8 billion rubles.

In terms of the import of veterinary drugs, Q3 2022 was no less than impressive. It also determined how the result of the first nine months would look like. The growth rate of the veterinary import in Q3 2022 was 32.3% in monetary terms and 28.4% in physical. As for feed supplements, both Q2 and Q3 2022 saw some issues, in particular the sanctions, which affected the logistics. Apart from August 2022, the import of feed supplements in Q3 was falling: –14.4% in rubles and –6.4% in tons.

The growth rates of the import of both veterinary drugs and feed supplements in January–September 2022 depended on the animal category. For example, the import of veterinary drugs for livestock went up 6.1%, while that for pets grew by only 2%. At the same time, the import of feed supplements for pets increased 62.5%, and that for farm animals fell 10%.

The number of veterinary drug brands was 504 in January–September 2022, down 106 brands from the same period last year. Among those drugs that are no longer imported into Russia, two drugs for livestock, Improvac by Zoetis and Cepravin DC by MSD, accounted for the largest import volumes. The vaccine Progressis by CEVA Asante Animale and the sedative drug Rometar by Bioveta had the best growth rates in monetary terms—its imports grew 785 and 338 times against January–September 2021, respectively. Both drugs are not new to the Russian market, but were barely imported in 2021.

The number of feed supplement brands went down as well—from 603 in January–September 2021 to 451 in January–September 2022. Among those feed supplements the import of which was suspended, Bioplex and Optigen by Alltech accounted for the largest imports. As for the best growth rates, the import of Normaminovit by Alpovet grew 151 times against January–September 2021, and the import of Excential by Orffa Additives increased 45.7 times against the comparison period. Both additives have been imported to Russia since before 2021, but the current growth rates stem from a low base.

Growth rates of the import of veterinary drugs and feed supplements to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT (2017–2021, Q1–Q3 2022)

Рус

Рус