Pharmaceutical Drug Production in Russia (August 2023)

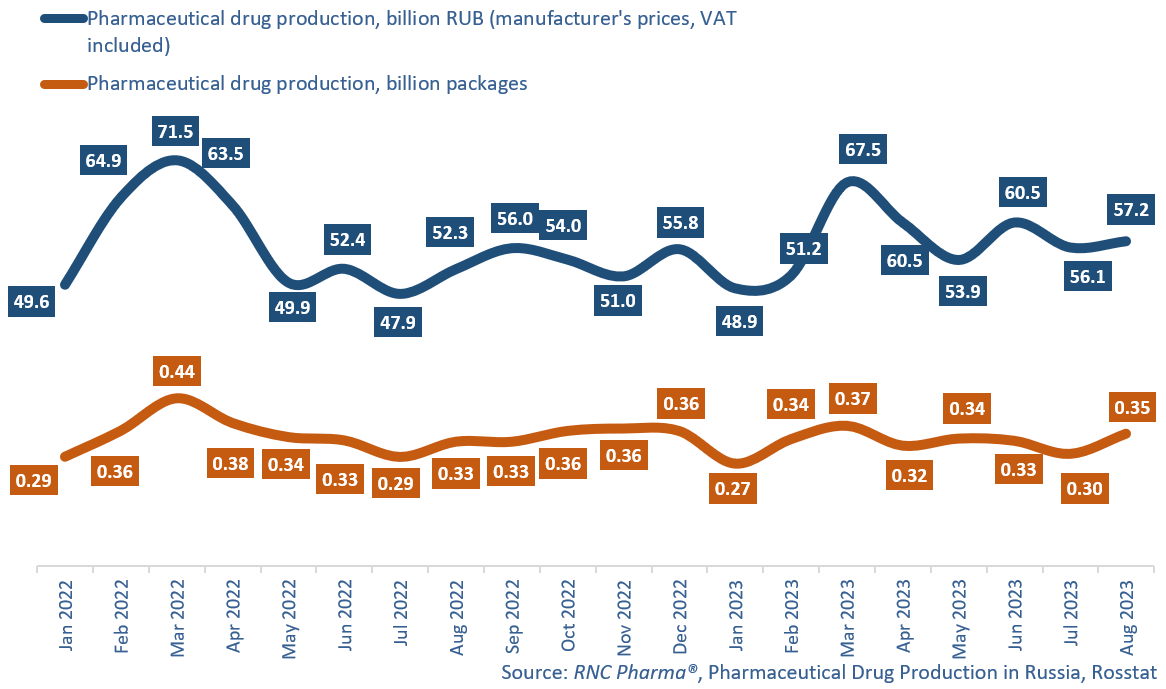

In January–August 2023, Russian manufacturers produced 455.8 billion rubles’ worth of ready-made pharmaceutical drugs (manufacturer’s prices, VAT included), up 0.9% from the same period last year, which is the first positive growth rate since January 2023. In physical terms, the production volume was 2.61 billion packages, down 5.3% from January–August 2022, or 51.4 billion minimum dosage units (MDUs), down 2.4%.

In August 2023, 57.2 billion rubles’ worth of ready-made drugs were produced, up 9.4% from August 2022—rather modest, compared to June and July 2023. In physical terms, the production volume was 350.1 million packages, up 6.3% from August 2022 (a 12-month-high), or 6.6 billion MDUs, up 1.3%.

The number of manufacturers in January–August 2023 was 424, up 25 from the same period in 2022. The product range also expanded: 1,402 INNs (up 47), 2,723 brands (up 172), and 9,196 SKUs (up 591).

The production volume of prescription drugs in January–August 2023 went down 0.6% in packages, but up 1.6% in MDUs. The production of OTC drugs, however, fell by 9.3% in packages and by 7.2% in MDUs. Novartis had the best growth rates among the top 25 companies with the largest production volume of Rx drugs. The company’s production in January–August 2023 nearly doubled from January–August 2022. Enalapril Hexal and Sotahexal, manufactured at Novartis Neva in St. Petersburg, contributed to Novartis’ growth rates the most. Novartis is followed by Organica (production increased 42%); Enalapril, Meldonium, Metoprolol, and Allopurinol contributed to the growth rates the most. Among the companies outside the top 25, Elpida increased its production 16 times against January–August 2022. The company produced anti-HIV prodrug Elpida

As for the largest manufacturers of OTC drugs, Slavyanskaya Apteka had the highest growth rates—its production went up 13.5 times against January–August 2022. Naphthyzin and Xylometazoline helped the company beat its own records for a few months in a row. Slavyanskaya Apteka is followed by Solopharm (production went up 34%); Gelangin, Xyloct, and Trecrezan contributed to the growth rates the most. Outside the top 25, Pharmasyntez and Woerwag Pharma had the best growth rates. Pharmasyntez increased its production 9 times against January–August 2022, and continues to actively develop its OTC portfolio through NSAIDs, in particular Nexemezin. The manufacture by Woerwag Pharma went up 5.7 times against the comparison period; the company keeps increasing the contract production of Magnerot, manufactured in Belgorod Oblast by Piq Pharma.

Pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (packages) and monetary terms (RUB, VAT included) (January 2022–August 2023)

Рус

Рус