Database Update: Veterinary Drug Retail Sales Audit in Russia (March and Q1 2020)

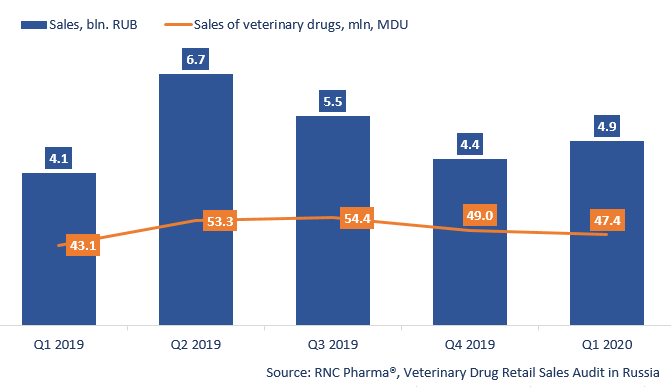

In Q1 2020, the sales of veterinary drugs in the retail market amounted to 4.88 bln RUB (retail prices, VAT included), with the dynamics of +20.4%. The high dynamics could be explained by a number of factors, in particular average price increase and increased demand. The latter could be attributed to atypical weather earlier this year, hence a shift in demand. If calculated in minimum dosage units (MDU), the market volume is 47.4 bln MDUs, with the dynamics of more than +10%.

The sales of veterinary drugs for pets have the highest dynamics (+22.5% in monetary terms). Dog medications contribute to the dynamics the most (sales grown by 34%). For comparison, the sales of cat medications have grown by only 10% over the same period. While the sales of preparations for livestock have fallen (-2.4%), the significance of this group for the retail market is relatively small, it accounts for only 6.9% of the total volume in monetary terms. As for any particular animal species, there were practically no obvious leaders in terms of sales dynamics.

Among the top 15 manufacturing companies with the largest sales volume of preparations for pets in monetary terms, Boehringer Ingelheim has the highest dynamics (+59%). Only four out of the company’s thirteen products in the market have negative dynamics. Drug for the reduction of proteinuria Semintra, cardiotonic drug Vetmedin, and antiparasitic Nexgard Spectra have the highest dynamics (sales grown by 2.3, 2.2, and 2.1 times, respectively). Boehringer Ingelheim is followed by MSD, with the dynamics of +50%. The sales of their Bravecto have doubled over the period.

Apicenna and MSD have the highest dynamics among the top 15 manufacturers of livestock drugs (+73% and +46%, respectively). Anticoccidic drug Stop-Coccid (sales grown by 10.6 times) and cephalosporin antibiotic Ceftiosan (by 3 times) contributed to the dynamics of Apicenna. As for MSD, the dynamics was that high thanks to the sales of non-steroidal anti-inflammatory drug Finadyne (sales grown by 25 times), antiectoparasitic drug Butox (by 20 times), and cephalosporin antibiotic for metritis in dairy cows Metricure (by 19 times).

Dynamics of retail market (households’ purchases) of veterinary drugs (Q1 2019 – Q1 2020)

Рус

Рус