Database Update: Pharmaceutical Drug Import to Russia (November 2019)

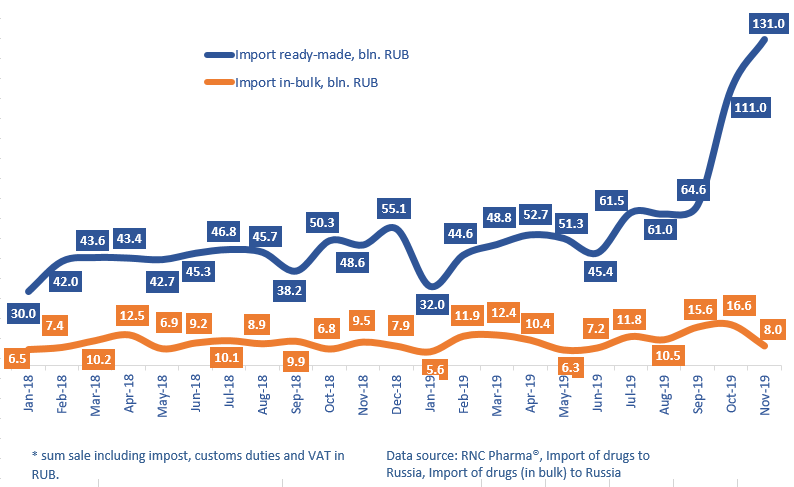

Between January and November 2019, Russia imported 703.9 bln RUB worth of ready-made pharmaceutical drugs (customs clearance prices, VAT included), which is in monetary terms (rubles) 47.7% higher than that of the same period in 2018, and 116.3 bln RUB worth of in-bulk drugs, with the dynamics in monetary terms of +18.9%.

Russia imported around 242 bln RUB worth of ready-made pharmaceuticals in October and November 2019 alone, which contributed to the high dynamics, since it is close to the usual results of 6 months. The importers sought to form the necessary stock before a labeling system was introduced, although the introduction was later postponed. However, the stock formation had started long before that. Starting in July 2019, the dynamics were significantly exceeding seasonal trends. The import of ready-made pharmaceuticals in November 2019 has grown by 2.7 times, with 131 bln RUB.

The dynamics in physical terms vary more significantly. The dynamics of the import of ready-made pharmaceuticals are +21.7% in units and +22.2% in minimum dosage units (MDU). Between January and November 2019, Russia imported 2.06 bln units of ready-made drugs, or around 38 bln MDUs. As for in-bulk drugs, the dynamics are -20.2% (units) and 3.06 bln MDUs.

Among the top 20 manufacturers of ready-made drugs, BMS has the highest dynamics, having increased its import by 6.7 times. Opdivo (import grown by 7.9 times in rubles) and Yervoy (by 7.8 times) contributed to the company’s dynamics. BMS is followed by Astellas (import increased by 3.3 times); the import of the company's Xtandi has grown by 17.3 times. Only 4 companies in the top 20 have negative dynamics: Abbott (-12%), Dr. Reddy’s (-3%), Gedeon Richter (-2%), and KRKA (-0.4%).

As for November 2019, Astellas and Roche have increased their imports by 16 and 12 times, respectively.

No in-bulk importer could boast the same high dynamics, though. Italfarmaco and Eisai have the highest dynamics, having increased their imports by 3.5 and 2.7 times, respectively. Gliatilin, packaged at Pharmacor Production, contributed to Italfarmaco’s dynamics, while Halaven and Lenvima, packaged at Pharmstandard, boosted the dynamics of Eisai.

Dynamics of import of pharmaceuticals, including homeopathic and seawater preparations, to Russia (excluding imports from EEU), free circulation prices including customs clearance and VAT, RUB* (January 2018 – November 2019)

Рус

Рус