Database Update: Audit of Veterinary Drug Retail Sales in Russia (November 2022)

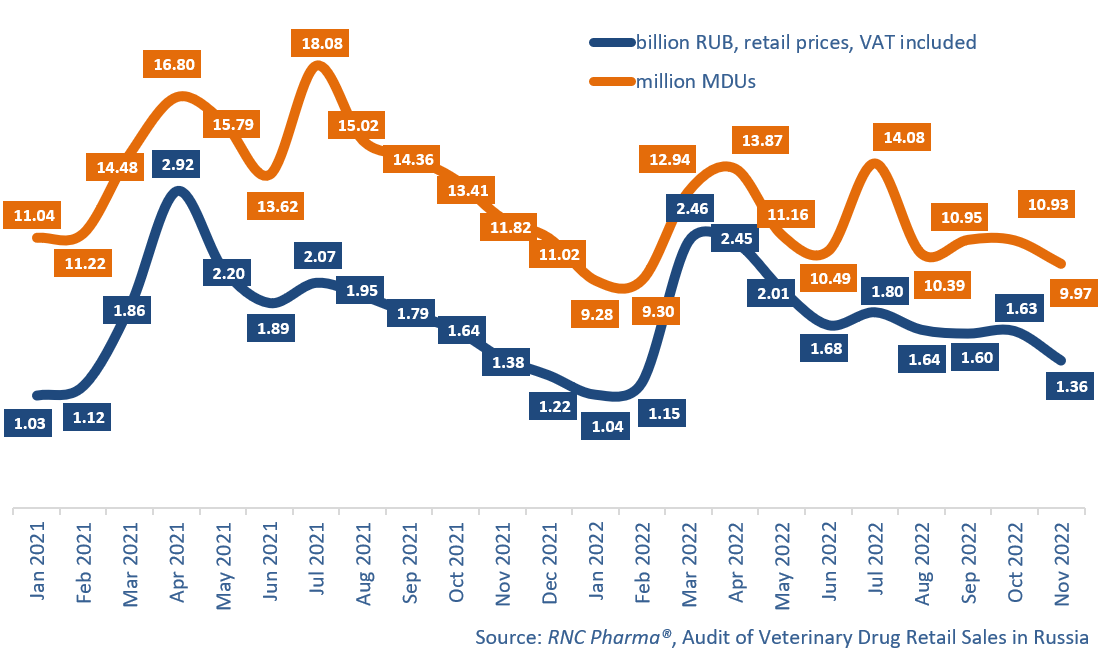

In January–November 2022, the sales of veterinary drugs in the Russian offline retail market were 18.8 billion RUB retail prices, VAT included), down 5.2% from the same period in 2021. The results could have been much worse if not for the activity in October–November 2022 compensating for the drop in consumption back in the spring and summer 2022. In physical terms, the sales were 123.4 million minimum dosage units (MDU), down 20.7%.

In November 2022, 1.36 billion rubles’ worth of veterinary drugs was sold, down 1.4% from November 2021. However, the sales plummeted 17% from October 2022. In terms of growth rate though, the November results were more or less the same as those in October. Because of the so-called “low season”, November 2021 saw pretty much the same growth rates. In fact, that means the market has finally gotten back to normal in terms of consumption, especially since the consumers seem to have used up what they stocked up on back in March 2022, returning to their usual consumption patterns. In physical terms, the sales in November 2022 were down 15.7% in MDUs, second best growth rate in 2022 after –10.6% in March.

The number of brands on the offline retail market in January–November 2022 was 1,263, up 18 from January–November 2021. Biofel, a vaccine for the prevention of infectious diseases in cats by Bioveta (Czech) had the best growth rates—its sales increased 23 times against January–November 2021, together with Maropital by Avicenna (Russia), a drug to prevent vomiting of various origins in dogs and cats (sales grew 21 times). Nephroantitox by Agrobioprom, a drug to protect kidney health, had comparable growth rates. While its sales went up 20.5 times against January–November 2021, its total sales were half those of Biofel and Maropital.

Despite the overall sales going down, the sales of many drugs on the market multiplied. In particular, the sales of Myoxyl by Russian Novaya Gruppa grew 679 times in MDUs. Depending on the dosage, the drug can be used as a sedative, muscle relaxant and analgesic for both livestock animals and pets. The sales of Vetbicillin by Belarusian Belvitunifarm, an antibacterial drug for livestock, went up 36 against January–November 2021.

The volume of the Russian veterinary drug retail market (online sales excluded) in monetary and physical terms (January 2021–November 2022)

Рус

Рус