Pharmaceutical Drug Production in Russia (September and Q1–Q3 2022)

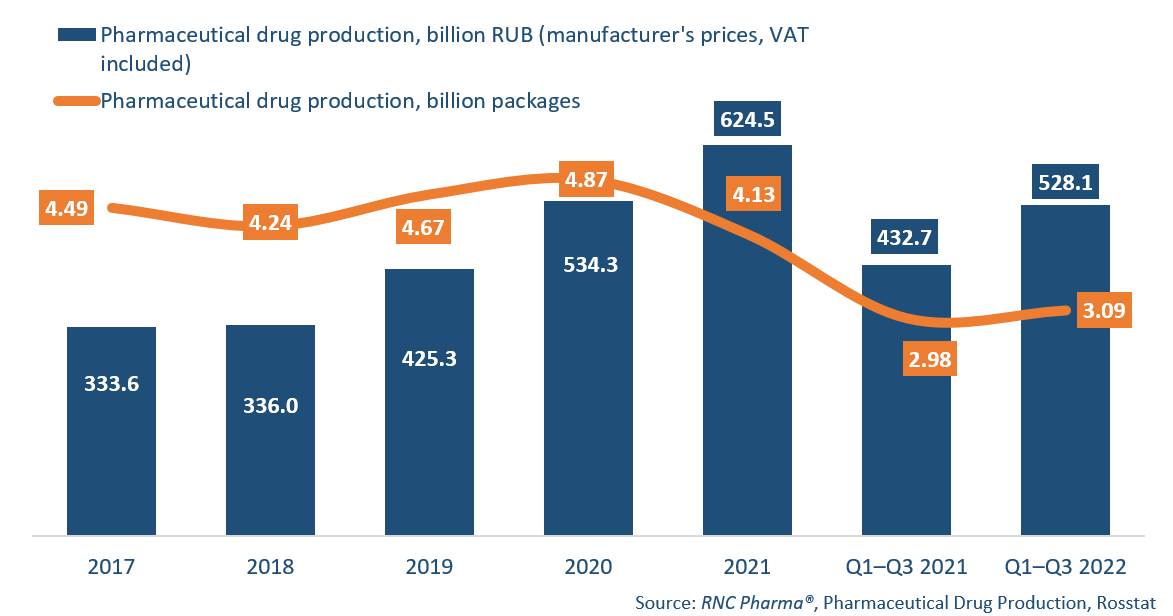

In January–September 2022, Russian manufacturers produced 528.1 billion rubles’ worth of ready-made drugs (manufacturer’s prices, VAT included), up 22% from the same period in 2021. In physical terms, the production volume was 3.09 billion packages, up 3.6% from January–September 2021. If calculated in minimum dosage units (MDU), the volume was 59 billion MDUs, 2.6% up from January–September 2021.

September 2022 saw mediocre results: 54.6 billion rubles’ worth of pharmaceuticals produced, up 13.7% from September 2021. In physical terms, the growth rate was –2% in packages and 0.5% in MDUs, with 328.9 million packages, or 6.35 billion MDUs, manufactured. Q3 was not impressive either, with the growth rate in monetary terms below the inflation rate (9.8%). In physical terms, the production fell 1.1% from Q3 2021.

Compared to last year, Russian manufacturers paid more attention to OTC drugs. In January–September 2022, they accounted for 54.4% of the total production volume against 50.6% in January–September 2021. In MDUs, however, the share of prescription drugs was 55.2%, although lower than a year before (56%).

The number of OTC brands in January–September 2022 was 939, up 65 brands from the same period last year. The production of Bismuthi tripotassium dicitrate had the best growth rates, having increased 43.4 times against January–September 2021. It was manufactured by two companies, with Ozon in Samara Oblast accounting for the largest volume. Bismuthi tripotassium dicitrate is followed by Vinylin, a drug created in the first months of the Great Patriotic War; its production grew 21.4 times against January–September 2021. The drug was manufactured at five enterprises at once, but Usolpharm accounted to the largest volumes, contributing to the total growth rates the most. Miramed by Evalar (Biysk) rounds out the top three—its manufacture grew 20.7 times against the comparison period. One of the first generics of antiseptic Miramistin by Infamed, it is now top three in its competitive group, taking away a share from the original drug.

The number of Rx brands went up from 1,653 in January–September 2021 to 1,739 in January–September 2022. The manufacture of Levinox by Solopharm had the best growth rates in physical terms—it increased 42.7 times against January–September 2021. Since the production began in September 2021, the so-called “low-base effect” was behind the high growth rates. Ethanol by Rosbio, forgotten since the COVID-19 pandemic, came second—its manufacture grew 40 times against January–September 2021. However, this is not a global trend, because there are around 15 direct alternatives to the drug, and the total production of ethyl alcohol preparations fell 11% over the year. Kemeruvir by Pharmasyntez (Irkutsk) rounds out the top three—its manufacture grew 35 times against January–September 2021 due to low production volumes in 2021.

Pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (packages) and monetary terms (RUB, VAT included) (2017–2021, Q1–Q3 2022)

Рус

Рус