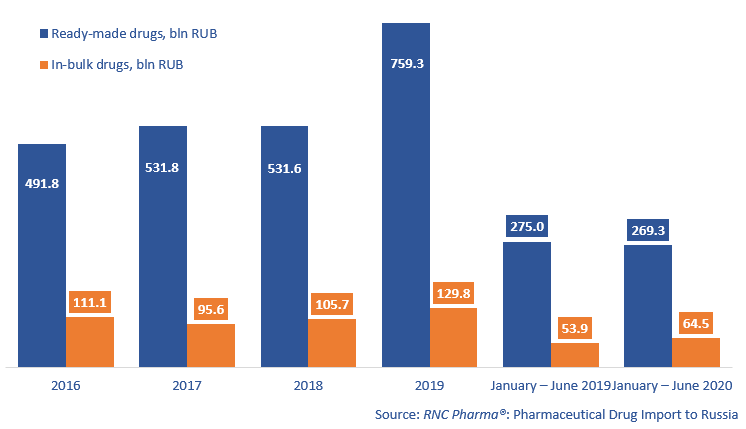

Pharmaceutical Drug Import to Russia (June and First Half of 2020)

Between January and June 2020, Russia imported 269.3 bln RUB worth of ready-made pharmaceuticals (customs clearance and VAT included), which is in monetary terms (rubles) 2% lower than in 2019. The dynamics were even lower in May 2020 (-27%), but in June, the importers sought to have their stocks replenished after it became clear that the launch of the labeling system would not be postponed again. As for in-bulk pharmaceutical drugs, the import volume amounted to 64.5 bln RUB, with the dynamics of +20%.

The imports of ready-made drugs started to grow back in May 2020, so that in June the dynamics in monetary terms reached more than 210%. The import volume was comparable to that between October and November 2019, in preparation for the first attempt to launch the labeling system.

The stock replenishment mainly concerned products of the upper price segment, therefore the dynamics in physical terms lagged significantly behind those in monetary terms. In June, the dynamics of the import of ready-made pharmaceutical drugs were +44% in physical terms, but that could not drastically change the dynamics for the period between January and June (-23%). The dynamics of the in-bulk import were -31.4% in minimum dosage units (MDU). The total import volume of ready-made and in-bulk drugs amounted to 14.2 bln MDUs, with the dynamics of -20.5%.

BMS has the highest dynamics (imports grown by 3.8 times in monetary terms) among the top 20 companies with the largest import volume in monetary terms. Yervoy and Abraxane contributed to the dynamics the most (imports grown by 52.5 and 13.2 times, respectively). Abraxane was also the most imported drug in monetary terms. Biogen Idec Limited, importing only Spinraza this year, also had high dynamics (imports grown by 3.7 times in monetary terms).

As for the top 20 importers of in-bulk drugs, Astellas has the best dynamics (4.6 times in monetary terms). The product that contributed to the company’s dynamics the most was Flemoxin Solutab, packaged at the facilities of Ortat owned by R-Pharm in the Kostroma Region. Astellas is followed by Eisai (imports grown by 3.2 times). Halaven and Lenvima, packaged by Pharmstandard, contributed the dynamics.

Dynamics of import of pharmaceuticals to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT, RUB (2016 – 2019, January – June 2020)

Рус

Рус