Inflation Rates in the Russian Retail Market of Medical Equipment and Devices (March 2024)

In 2023, medical equipment and devices on the Russian retail market (e-com included) went up in price 6.2% from 2022. The inflation rates were vastly different for various types of medical equipment. In particular, the prices for blood glucose monitors went up the most, with the inflation rate never going down below zero, unlike the other four types of equipment. In March 2024, the inflation rate for glucose meters was more than 85.5% (Fig. 1). Another peculiarity is that the prices index in the online market was significantly higher than that in the offline segment. The online prices for glucose monitors grew by more than 86% against 68% in the offline channel. The total price index in the category was 70.1% in Q1 2024.

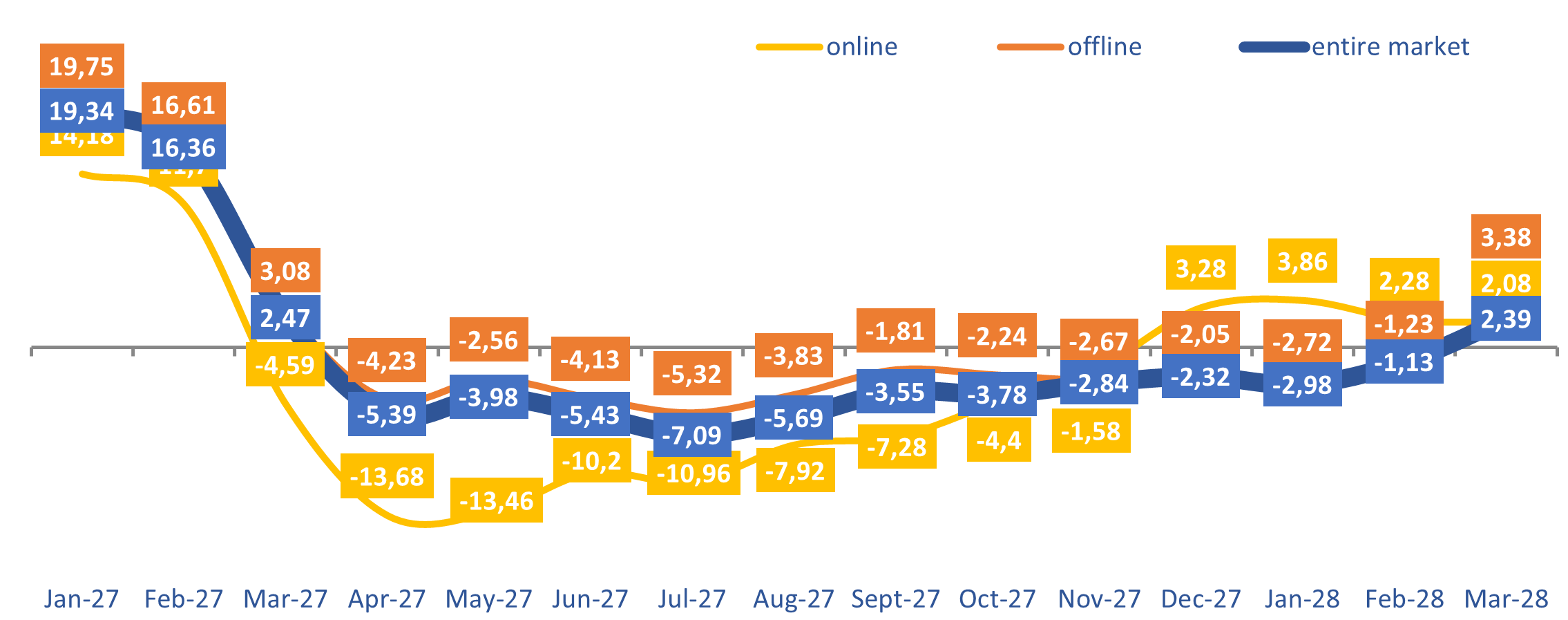

At the same time, the prices for test strips were falling during the most part of 2023. The price was at a year-low in the spring and summer; in particular, the inflation rate was down 7.1% in July 2023 (Fig. 2). In January–March 2023, the average price went up, peaking in January and February 2023 with 19.3%. In 2024, the price went up as lat as March, in both online and offline segment, reaching 2.4%. In Q1 2023, the price index was down 0.4%.

Fig. 1. Inflation rates* in the glucose monitor retail market in January 2023–March 2024, %

Fig. 2. Inflation rates* in the test strip retail market in January 2023–March 2024, %

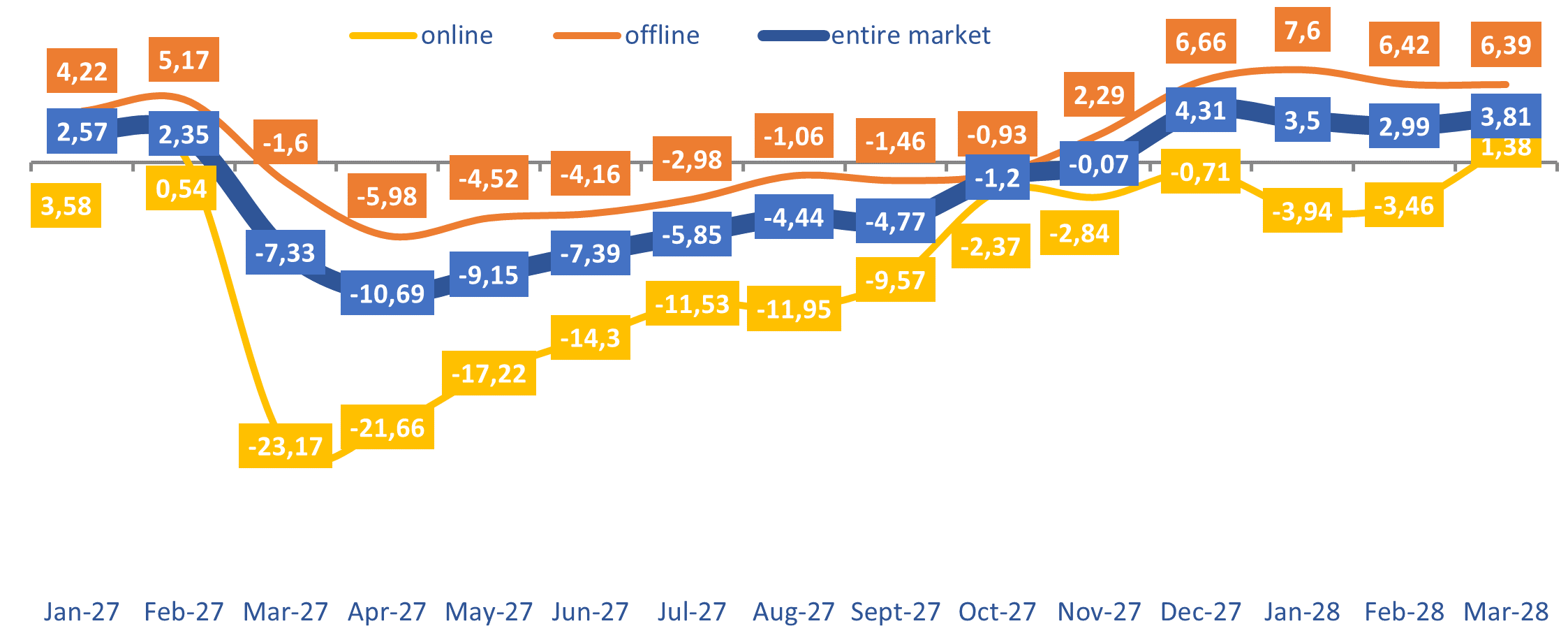

The prices for nebulizers were fluctuating in the analyzed period. In the spring 2023, the prices fell in both online and offline markets—by as much as 23.2% in e-com (Fig. 3) and by only 1.6% in the offline channel. In November 2023, the average prices for nebulizers once again started to grow, with the price index at 6% until March 2024. As for e-com, March 2024 was the month when the prices finally went up, with the price index at 1.4%. The total inflation rate was 3.3% in January–March 2024.

Fig. 3. Inflation rates* in the nebulizer retail market in January 2023–March 2024, %

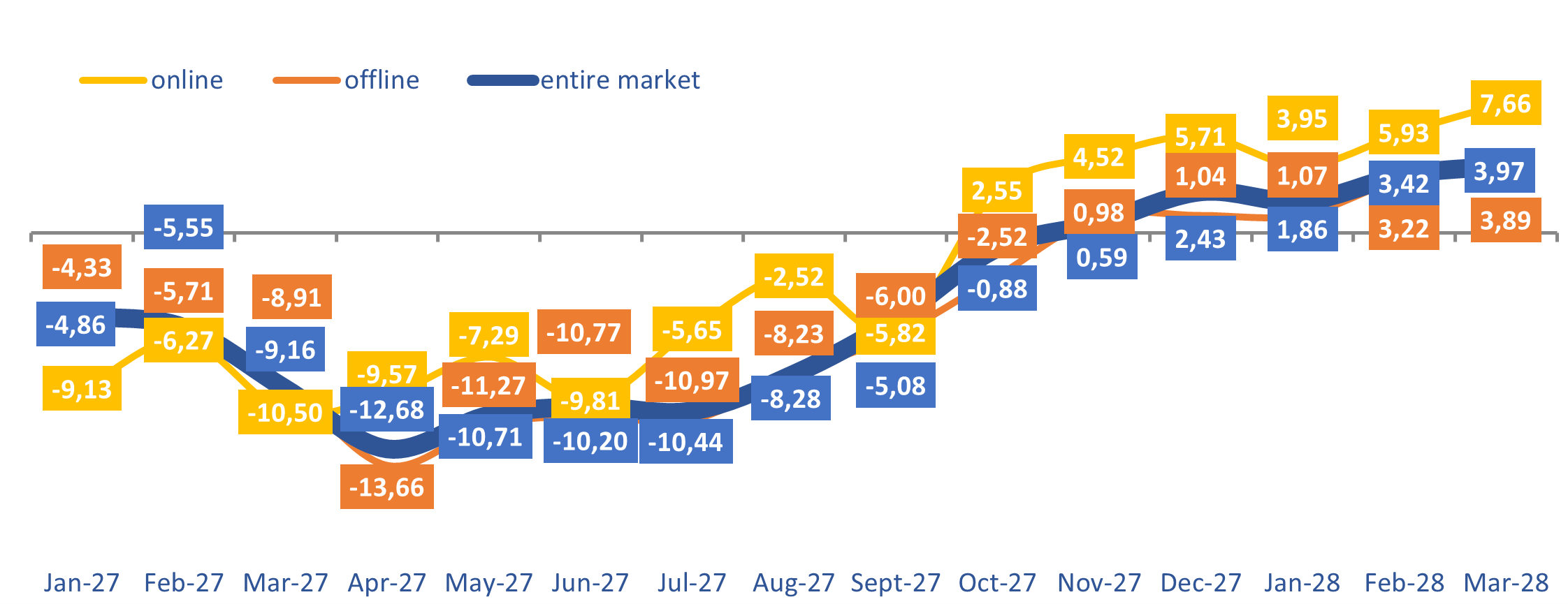

The prices for medical thermometers were falling in 2023. In November 2023, the prices went up 0.6% and then continued to grow further, with the inflation rate peaking in March 2024 at 4%. The price indices were practically the same both offline and online. In Q1 2024, the prices for thermometers went up 2.3%.

Fig. 4. Inflation rates* in the thermometer retail market in January 2023–March 2024, %

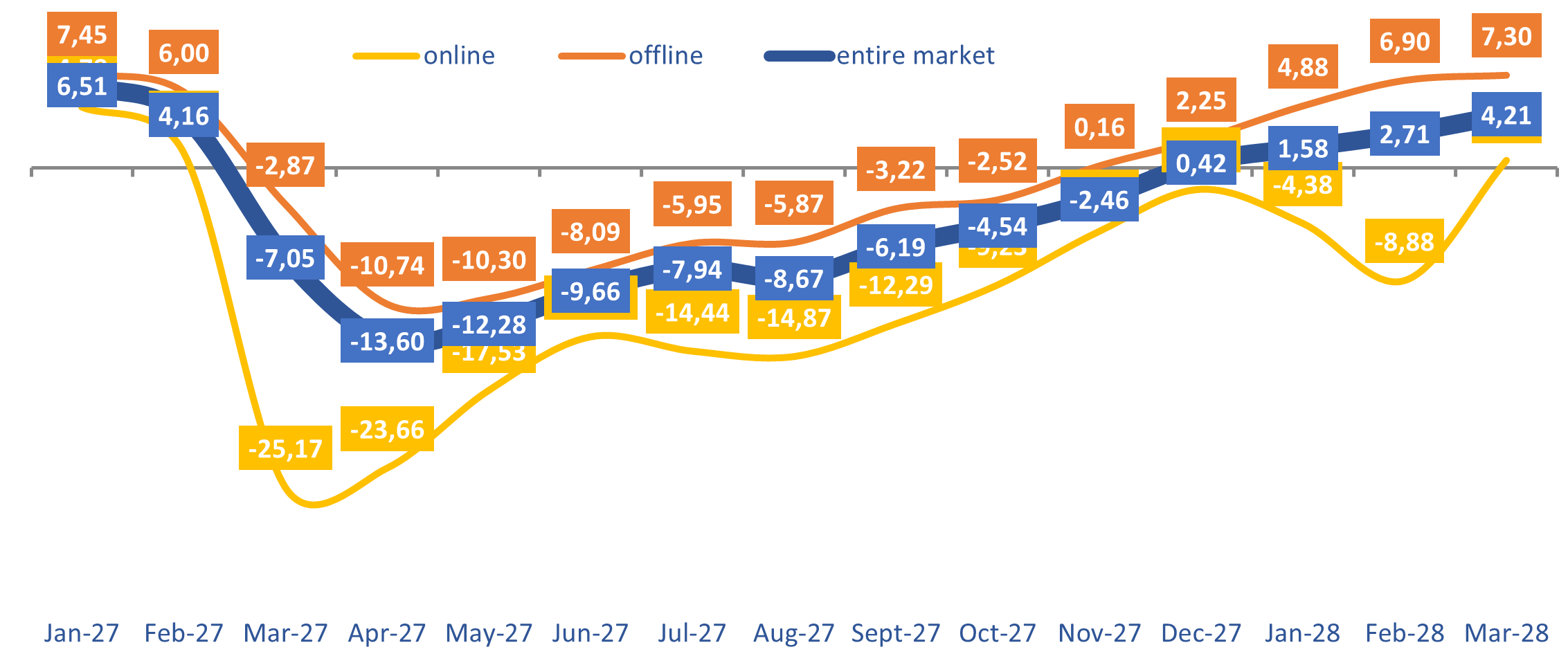

In 2023, the prices for blood pressure monitors were falling as well, with the inflation rates in e-com significantly lower than those in the offline segment. The online prices went down 25.2% in March 2023. The offline prices started to grow again in December 2023, when the inflation rate was 0.4%, while the online prices went up 0.6% as late as March 2024. The total inflation rate was 2.8% in Q1 2024.

Fig. 5. Inflation rates* in the blood pressure monitor retail market in January 2023–March 2024, %

Рус

Рус