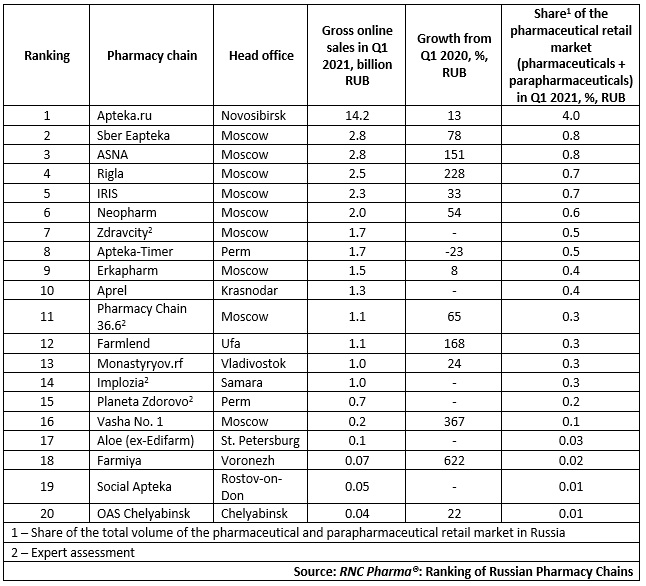

Top 20 Online Pharmaceutical Retailers in Russia (Q1 2021)

Between January and March 2021, the total volume of the online sales or reservation of pharmacy products (pharmaceutical drugs and parapharmaceuticals) in Russia amounted to 46.2 million rubles (end-user prices, VAT included), 24% up from the first quarter of 2020, which is, considering the drop in the total volume of the Russian pharmaceutical and parapharmaceutical market, is a real success. However, it should be noted that it was parapharmaceuticals that contributed the most. The growth rate of the online sales and reservation of pharmaceutical drugs was +13.4%, and while this is a lot, it is still 6.7% down from 2020. Besides, the laws prohibiting the online sale of Rx drugs is an objective obstacle.

The e-commerce segment accounts for 13.1%* of the Russian pharmaceutical market in Q1 2021, against 9.7% in Q1 2020. We can see a natural process now, when customers are starting to choose the online segment over the conventional pharma retail.

In the analyzed period, the total sales volume of the top 20 companies amounted to 38.2 billion rubles (end-user prices, VAT included), which is around 82.7% of the online pharmaceutical sales. Interestingly, the shares of the top 20 companies have been dropping as a result of the active development of players outside the top 20. Apteka.ru is still the leader of the segment, with the share of 4% of the market (parapharmaceuticals included). The company’s growth rate is, however, very mild, +13%, which is lower than the general growth rates of the e-com market. The situation will probably get better after the company acquires a controlling stake in the Erkapharm group, but the general strategy of the service development, by adding new tools as well, will determine how long this effect will last. Otherwise, the company simply will not be able to resist the active development of its competitors.

Farmiya (Voronezh) storms into the ranking with the highest growth rate; the company’s sales increased 7.2 times. It is not the only company whose sales increased multiple times, though. The Moscow chain Vasha No. 1 comes second (sales increased 4.7 times), followed by Rigla (3.3 times) and Farmlend (2.7 times). Asna is also worth mentioning; its sales went up 2.5 times.

Not taking into account the results of Rigla and Asna, players outside the top 20 made a real breakthrough in the development of the e-com segment. In fact, this is why the shares of the top 20 companies dropped. However, the results of such companies as Sber Eapteka, Neopharm and Pharmacy Chain 36.6 are without exaggeration outstanding; all these companies with historically very well developed online services have double-digit growth rates exceeding the average growth rates, which is even technically a very difficult task against the background of the active growth of competitors.

Тop 20 Russian online pharmaceutical retailers in Q1 2021**

* Only organizations specializing in the sale of medicinal products were included in the ranking. The volumes mentioned do not include the revenue of representatives of the gray online business supplying original drugs to Russia from other countries and services selling generics unregistered in Russia

** OZON (www.ozon.ru) was excluded from the ranking due to its refusal to provide the data required

Рус

Рус