Veterinary Vaccine Import to Russia (Q1 2020)

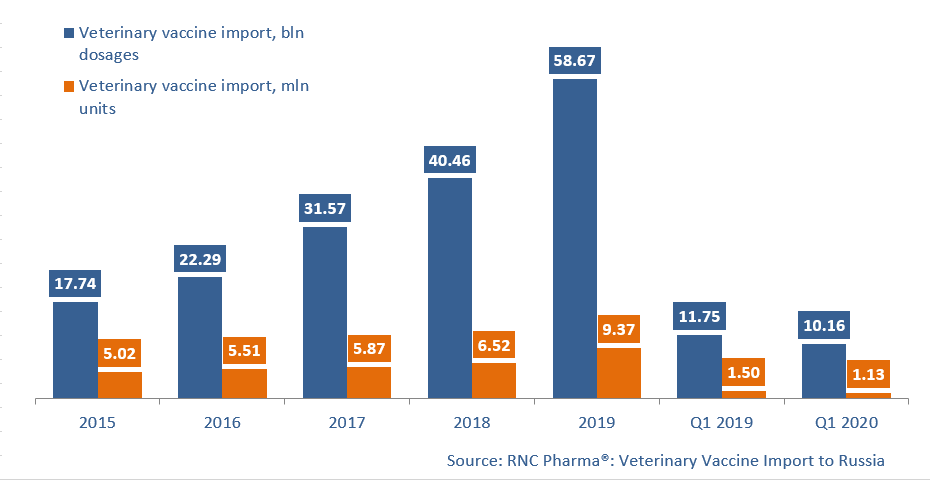

Between January and March 2020, Russia imported 2.1 bln RUB worth of veterinary vaccines (customs clearance prices), which is in monetary terms (rubles) 8.4% lower than that of the same period in 2019. The dynamics in physical terms (units) are as low as -24.8%, or, if calculated in dosages, 13.5%. The import volume amounts to 1.13 mln units, or around 10.16 bln dosages.

The dynamics depended on the vaccine type. The import of combined vaccines had the lowest dynamics in monetary terms, -19.6%. However, the import volume was rather low, 120 mln RUB, which is less than 6% of the total import. The import of live and inactivated vaccines fell at about the same pace, with the dynamics of -7.9% and -7.3% in monetary terms. Live vaccines account for 50% of the import in monetary terms, while inactivated ones for 44%.

The difference is far more prominent in physical terms (dosages). Live vaccines account for 97.5% of the import, inactivated ones for around 2.5%, and combined for less than 0.01%. The dynamics of the import of inactivated vaccines are +220%, those of the import of live ones are -15%, and -43% for combined ones.

Only 10 companies imported live vaccines to Russia in Q1 2020. Biovac (Israel) and Eli Lilly (USA) have the highest dynamics in monetary terms (imports grown by 3.8 and 3.4 times, respectively). Biovac imported Vir vaccines for avian infectious bronchitis and virulent Newcastle disease, while Eli Lilly imported their Avipro vaccines, mostly for infectious bursal disease, chicken anaemia virus, and salmonellosis.

As for inactivated vaccines, there were 14 companies. Daesung Microbiological Labs (South Korea) has the highest dynamics, the company’s imports have grown by 3.7 times in monetary terms. It imported only Circo Pigvac, vaccine for porcine circovirus infection.

Among the four companies that imported combined vaccines to Russia in Q1 2020, only Boehringer Ingelheim had positive dynamics. The company’s imports (dog vaccine Eurican) have grown by 2.6 times.

Dynamics of veterinary vaccine import to Russia, free circulation prices (customs clearance included), 2015 – 2019, Q1 2020, bln RUB

Рус

Рус