Database Update: Audit of Veterinary Drug Retail Sales in Russia (December 2021)

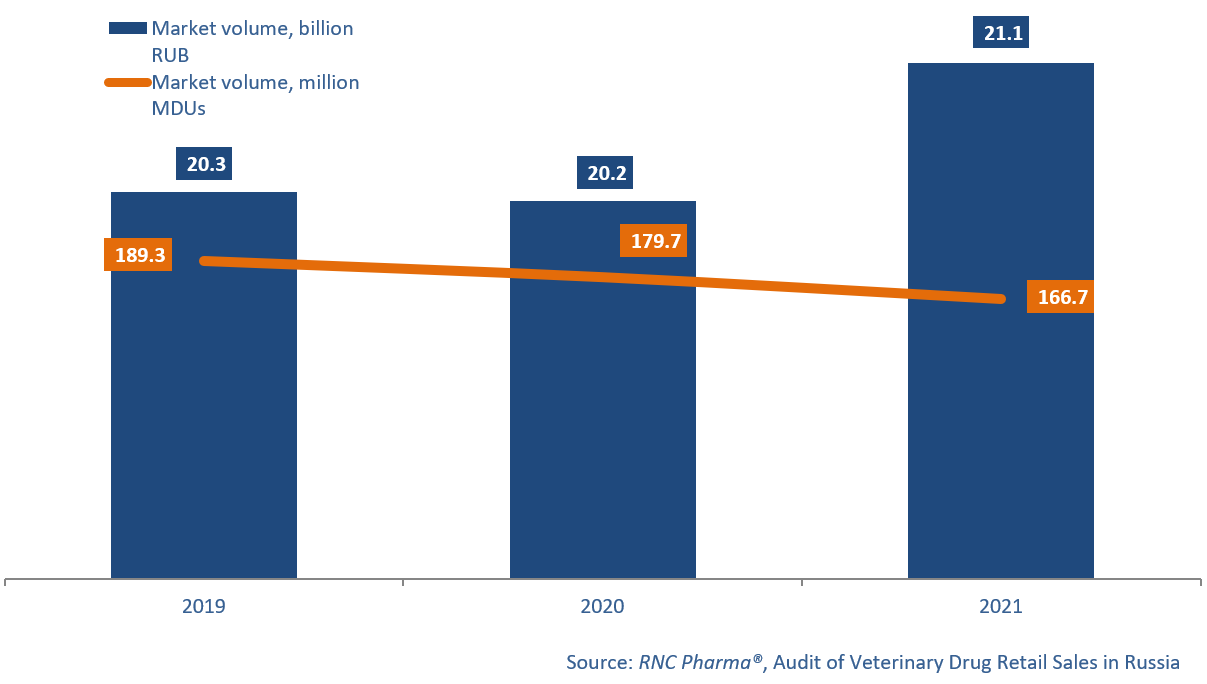

In 2021, the sales of veterinary drugs in the Russian retail market amounted to 21.1 billion rubles (retail prices, VAT included), up 4% from 2020. While that seems to be a fine result, especially considering the growth rates of –0.3% in 2020, it is obvious that the inflation rate influenced the growth rates in 2021. In physical terms, the growth rates kept falling (–7.2% in monetary dosage units, or MDUs), and the total sales volume was 166.7 million MDUs.

The Laspeyres price index in the market at the end of 2021 was 7.2%, which is much higher than that a year ago (6.3%). Rising prices tend to significantly reduce the activity of consumers, and most importantly, influence consumer behavior, leading to various strategies of sustainable consumption. For example, the share of products sold in smaller packages in 2021 increased to 27% in MDUs against 25% in 2020.

Despite those trends, there is practically no signs of import substitution in the veterinary retail market, while import substitution has been one of the key trends in the pharmaceutical market in recent years. The share of domestic producers in the retail market has been declining for the second year in a row, both in monetary and physical terms. In 2021, domestic products accounted for 40.8% in monetary and 63.6% in physical terms against 43.6% and 70% in 2019, respectively.

Manufacturers from Belarus had the best growth rates (35% in monetary terms) among the 10 countries with the largest sales volume in the Russian veterinary retail market. Rubikon, which primarily exports products for livestock, showed the highest growth rates, with antiseptic insectoacaricide Rateid and antibacterial Polybrominated Concentrate Powder contributing to the company’s growth rates the most. Belarus is followed by Spain with 16.2%. However, only one company, Livisto Group, made a significant contribution to the growth rates, with its own 26% thanks to the sales of NSAID for pets Petcam. Manufacturers from the USA round out the top three with the growth rates of 9.6%. Zoetis increased their sales by 22%, with insectoacaricide Simparica and antibiotic Synulox contributing to the growth rates the most.

As for Russian manufacturers, Askont+ and Agrobioprom had the most impressive growth rates, +19% for both companies. The sales of the Gabivit-Se vitamin and mineral complex contributed to the growth rates of Askont+ (the sales increased 2.3 times), and sedative and antiemetic for pets Vetspokoin (+42%) and antifungal Fungivet (+52%) for Agrobioprom.

The volume of the Russian retail market of veterinary drugs (online sales excluded) in monetary (RUB, end user prices, VAT included) and physical (MDU) terms (2019–2021)

Рус

Рус