Pharmaceutical Drug Import to Russia (September and Q1–Q3 2022)

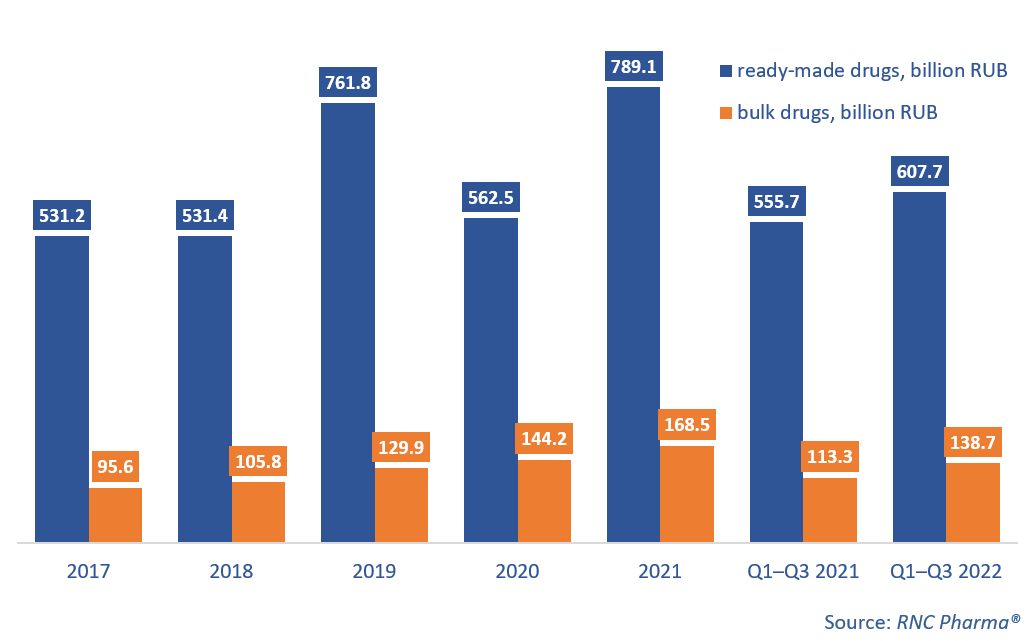

From January to September 2022, Russia imported 607.7 billion rubles’ worth of ready-made pharmaceutical drugs (customs clearance and VAT included, imports from the EEU excluded), up 9.4% from the same period in 2021. The import of bulk drugs grew 22.4%. In physical terms, the import of ready-made drugs was 1.24 billion packages, or 23.9 minimum dosage units (MDU), up 6.9% in packages and 8.6% in MDUs. As for bulk drugs, the growth rate was 38%, with around 1 billion MDUs imported.

The import of pharmaceuticals in September 2022 was rather mediocre: 72 billion rubles’ worth of ready-made drugs, up 9% from September 2021, and 17.8 billion rubles bulk drugs, up 16%.

Pharmaceutical drug imports changed significantly this year due to both the sanctions and product portfolio optimization, since more expensive logistics and increasingly competitive Russian products have made the import of certain products unnecessary. The localization process has been affecting the imports as well. The number of the INNs of imported ready-made products went down from 2100 in January–September 2021 to 2073 in January–September 2022. Gardasil by MSD, Tresiba by Novo Nordisk, and Zepatier by MSD accounted for the largest import volumes in monetary terms. Tresiba and Zepatier are now imported as bulk drugs, as the production was localized in Russia. As for Gardasil, in 2021 it was imported in amounts comparable to 10 years’ worth of imports.

Soliris by Alexion had the best growth rates among ready-made drugs—its imports grew 2,700 times against January–September 2021. However, the drug was removed from the state register in mid-2020 and is now imported in trace amounts under a special procedure. Soliris is followed by Koselugo by AstraZeneca, the import of which increased 787 times against January–September 2021. The certificate for the drug was issued in late 2021, allowing regular imports.

As for bulk drugs, the number of INNs went down from 219 in 2021 to 201 in 2022. Among those 18 drugs that are no longer imported to Russia, Dufalac by Abbott and Dzhadeny by Novartis accounted for the largest import volumes last year. The manufacture of both drugs is now fully localized at enterprises owned by the respective companies. Gemblira by Roche had the best growth rates in monetary terms—its imports grew 68.5 times against January–September 2021. The drug is packaged at the Dobrolek enterprise owned by Pharmeco.

Growth rates of pharmaceutical imports to Russia (EEU countries excluded), free circulation prices, customs clearance and VAT included, RUB (2017–2021, Q1–Q3 2022)

Рус

Рус