Pharmaceutical Drug Production in Russia (August 2024)

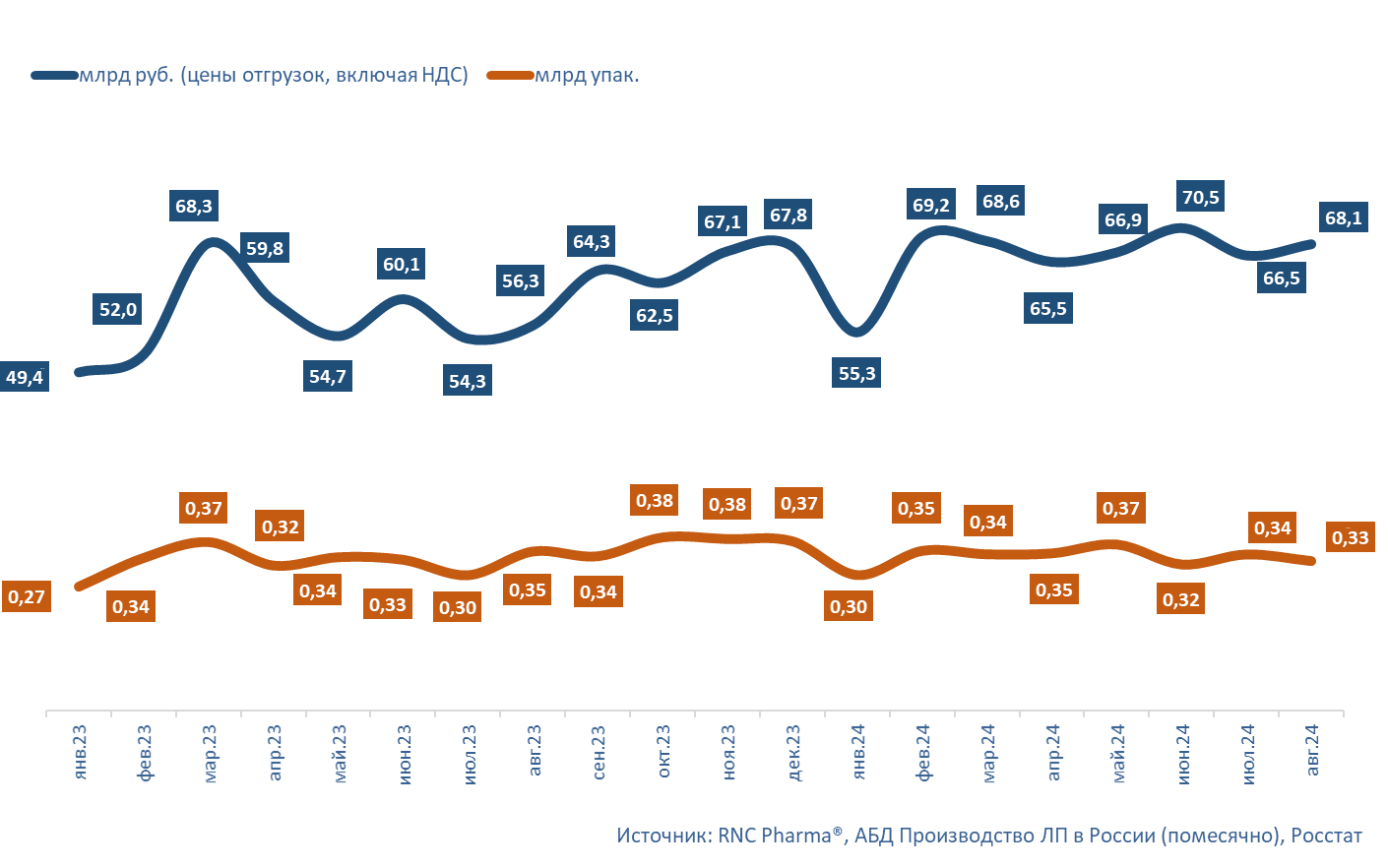

In January–August 2024, Russian manufacturers produced 530.7 billion rubles’ worth of finished pharmaceutical drugs (manufacturer’s prices, VAT included), up 16.7% from the same period in 2023. In physical terms, it was around 2.7 billion packages, up 3.2% from January–August 2023. If calculated in minimum dosage units (MDU), the manufacture was 54.6 billion, up 6.3% from the same period in 2023.

In August 2024, manufacturing companies demonstrated high performance. In total, 68.1 billion rubles’ worth of finished pharmaceuticals were manufactured, up 21% from August 2023. In physical terms, however, it was 329 million packages (down 6.1%), or 6.5 billion MDUs (down 2.4%).

The number of finished drug manufacturers in January–August 2024 was 441, up 19 from the same period last year. At the same time, 26 out of those halted production, while 45 started manufacturing. The manufacturing output of OTC drugs went down 0.7% from January–August 2023, while that of prescription drugs went up 7.5%. The share of Rx drugs, 49.6%, almost reached that of OTC drugs.

Out of the top 20 prescription drug manufacturers by manufacturing output, 16 saw their production grow. Sotex had the best growth rates (up 83.8% in packages), while Solopharm’s production suffered the worst fall (by 25.3%). Drugs outside the top 20 had the best growth rates, in particular, the manufacture of Abacavir + Lamivudine (by Indian Lok-Beta Pharmaceuticals) increased 119 times against January–August 2023. The drug is produced at Pharmconcept in Redkino (Tver Oblast). The manufacturing output of Etravirine by PSK Pharma grew 103 times against January–August 2023. However, the production started in May 2023.

As for OTC drugs, eight top-20 companies saw their manufacture fall, including such major companies as Pharmastandard (down 0.3%), Ozon (down 16.7%), Stada (down 21.2%), and others. Renewal had the best growth rates in physical terms, 57.7%. The manufacture of its Acetylsalicylic acid and mucolytic Eifa AC increased fivefold against January–August 2023. The following top-20 companies also demonstrated high performance: Uralbiofarm (manufacture went up 44.7%), thanks to Citramon and Acetylsalicylic acid, and Valenta (up 27.5%), thanks to Ingavirin. The manufacture of Dioctahedral Smectite by Genel RD, launched in August 2023, grew 32 times against January–August 2023, which was the best growth rate outside the top 20.

Fig. Pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies at owned or contract plants, in physical (packages) and monetary terms (RUB, VAT included) (January 2023–August 2024)

Рус

Рус