Database Update: Audit of Veterinary Drug Retail Sales in Russia (August 2022)

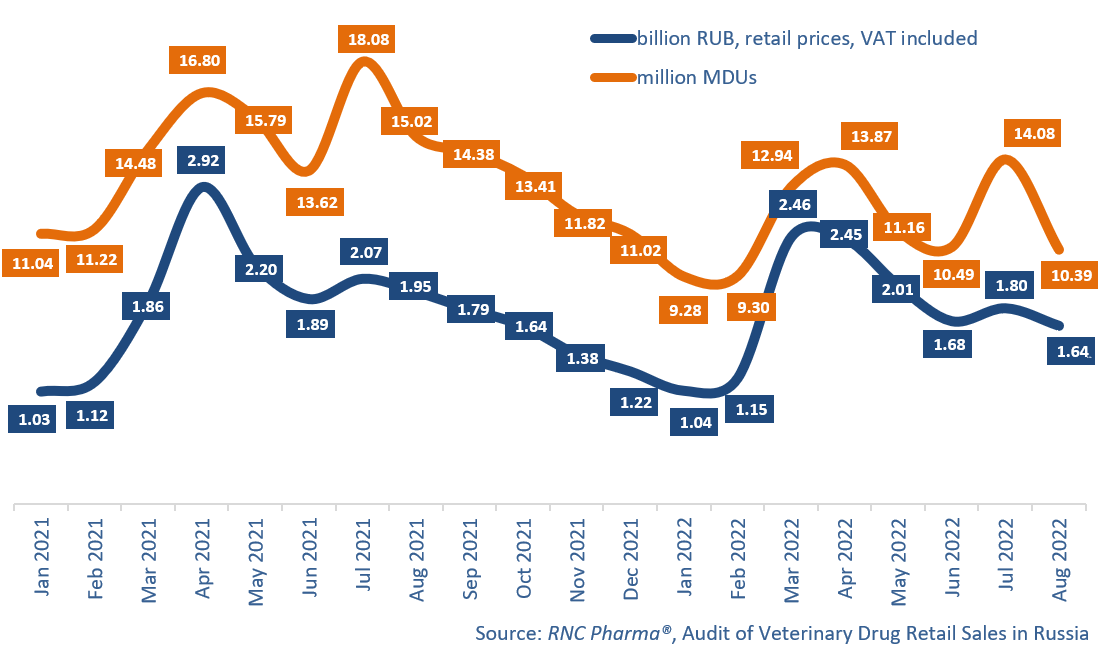

From January to August 2022, the offline sales of veterinary drugs in the Russian retail market were 14.2 billion RUB (retail prices, VAT included), down 5.4% from January–August 2021. In physical terms, the sales were 91.5 million minimum dosage units (MDU), down 21%.

August 2022 had the worst growth rates in the past 2.5 years—sales went down 16% in monetary and 31% in physical terms from August 2021. While the period between 2020 and 2021 saw falls in sales as well—especially due to the coronavirus pandemic, those short-terms falls were a result of climate patterns which could not but affect the demand. This year, the weather anomalies (central Russia had unusually warm weather in August) were joined by rush demand, dropping household incomes, and offline-turned-online customers. Veterinary sales have been declining in both monetary and physical terms for the 5th month in a row, but September can change things up a bit, since typical fall weather hit Russia exactly on September 1. That is sure to affect the sales of those veterinary drugs that are usually trending in fall, but the results will be visible in a month.

More than half of the top 20 companies with the largest sales in monetary terms had negative growth rates in January–August 2022. Even the top 3 companies lost in sales: the sales of MSD dropped 5.2%, Elanco went down 15%, and Zoetis 21%. KRKA (Slovenia) and Vetbiokhim (Russia) had high growth rates, though—39% and 33.7%, respectively. The sales of KRKA’s antiparasitic drug Selafort and antimicrobial drug for the treatment of otitis Otoxolan contributed to the growth rates the most (the sales of Selafort doubled, and the sales of Otoxolan grew 6.7 times against January–August 2021). Vetbiokhim increased sales of its veterinary vaccines—Asterion, a combined vaccine for dogs (sales grew 6.3 times), Rabiks, a vaccine for the prevention of rabies in dogs (sales grew 4.1 times), and Rabifel, for the prevention of rabies in cats (sales went up 3.3 times).

As for the top 20 companies with the largest sales in physical terms, only four managed to increase their sales. Askont+ (Russia) had the highest growth rates, doubling its sales, with two drugs for livestock, Metronidazole (sales grew 5.4 times) and Cobalt chloride (1.7 times), contributing to the growth rates the most. Livisto Group also had high growth rates (33%), thanks to the sales of two drugs for small pets, the antibacterial drug Doxifin (+75%) and the NSAID Petkam (+17%).

The volume of the Russian retail market of veterinary drugs (online sales excluded) in monetary and physical terms (January 2021–August 2022)

Рус

Рус