RNC Pharma: Russia-Based Companies Have Been Contributing to Pharmaceutical Market Growth for 3 Years

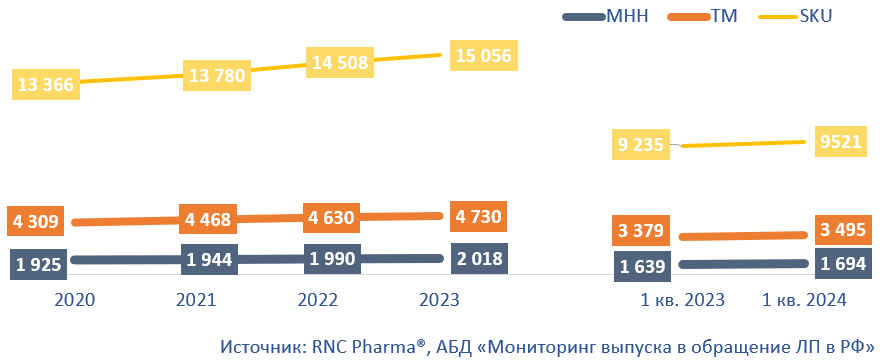

In Q1 2024, the Russian pharmaceutical market had 1.4 billion packages of drugs on sale, up 2.4% from Q1 2023. Throughout 2023, 5.88 billion packages entered the market, and in 2022, around 5.95 billion. Despite the volume decreasing in physical terms, the range of medicines is expanding. In 2023, more than 15,000 SKU (stock keeping units) of pharmaceutical drugs were put into circulation, up 548 from 2022 (Fig. 1).

The number of trademarks (TMs) and INNs also increased—4,700 TMs in 2023 against 4,600 TMs in 2022. However, a significant number of TMs are also leaving the Russian market; for example, supplies of drugs of more than 390 brands that were present in 2022 were suspended in 2023. The number of INNs in 2023 increased by 28 from 2022. Interestingly, some of the new INNs were not previously present on the Russian market, including pelubiprofen (Pelubio) and polmacoxib (Polmaxib). The rights to both drugs, registered in Russia in 2021, belong to Russian PharmArtis. Finished forms of the drugs are manufactured in South Korea and packaged at one of the Pharmstandard enterprises. Both drugs are NSAIDs; polmacoxib is also a coxib used for the symptomatic treatment of osteoarthritis.

Another example of an INN that has not previously been sold in Russia is rizatriptan. The anti-migraine drug came into circulation in 2023, having been registered in 2022. Rizatriptan drugs are produced by two companies, Sotex and NovaMedica. The latter was responsible for the localized production of the finished dosage form in Russia. Sotex is currently a distributor of the drug produced in India.

Some of the drugs that entered the market last year contain new combinations of active ingredients. One of the examples is anticongestant Rhinomaris Advance by Croatian Jadran. The nasal spray contains xylometazoline and sodium hyaluronate; these active ingredients were previously registered in Russia separately. This combination was first approved by the Ministry of Health in 2022, and the drug was put into circulation in 2023.

The product range continued to expand in Q1 2024, with the number of SKUs reaching 9,500, up 286 from the same period in 2023. The number of TMs was 3,500, up 116, while that of INNs was 1,700, up 55.

Fig. 1. Pharmaceutical drugs put into circulation on the Russian pharmaceutical market

Interestingly, it is mainly Russian companies that have been responsible for the expanded range of pharmaceutical drugs on the market over the past few years. The number of drugs produced by Russian companies is more than twice the number of SKUs by foreign manufacturers. In addition, the number of Russian SKUs has been growing in the past 4 years, while that of foreign drugs has been decreasing. In 2023, the number of Russian SKUs went up 6% from 2022, reaching 10,500, while that of foreign SKUs fell 1%, to 4,700. This trend is a consequence of both import substitution and localization of foreign companies that are expanding the range of products manufactured in Russia.

In January–March 2024, the number of Russian SKUs increased by 282, to more than 6,500. The number of foreign SKUs decreased slightly, to just over 3,000.

Fig. 2. Changes in product range of Russian / foreign companies on the Russian pharmaceutical market, SKU

Рус

Рус