Database Update: Audit of Veterinary Drug Retail Sales on Russian Online Marketplaces (December 2021)

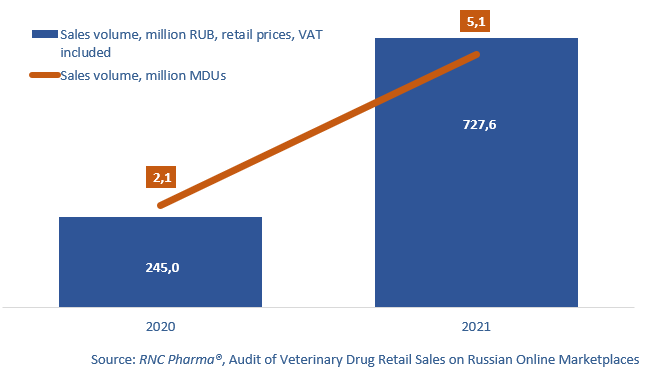

In 2021, the retail sales of veterinary drugs through the top online marketplaces in Russia amounted to 727.6 million rubles (retail prices, VAT included), having tripled from 2020. In physical terms, the sales increased 2.5 times from 2020, if calculated in minimum dosage units (MDU). The sales volume was 5.1 million MDUs.

The growth rates in both monetary and physical terms differed throughout 2021. The best growth rates were observed from January to April 2021—a 5-6-fold increase in sales in monetary terms. In May–August 2021, while the growth rates remained rather high, they were far behind those at the beginning of the year (the sales either doubled or tripled). However, the high growth rates came back in the last months of 2021—70% in November and 64% in December 2021. That was, on the one hand, the influence of the “low season.” On the other, it demonstrated the end of the explosive growth stage, when suppliers were discovering all the advantages of working online, and the transition to a phase of steady development with a full set of conventional competitive tools.

The total number of manufacturing companies selling online last year remained practically the same, with 87 at the end of 2021 against 84 in 2020. In fact, all the top veterinary retail companies started operating online as early as 2020. Not only the range of products sold online failed to grow in 2020, but also the number of trademarks noticeably decreased. It was the active promotion of the top brands that helped the development of the online segment in the first place.

Predictably, MSD had the best results among the top 20 manufacturers of veterinary drugs in 2021, with ones of the most outstanding growth rates (4.4 times in rubles). While the company sells 12 trademarks online, Bravecto accounted for more than 90% of the sales. Among the top 20, only Beaphar had actually high growth rates—its online sales increased 6.6 times over the year. The sales of the Beaphar Bio collars for kittens and cats, as well as for puppies and dogs, contributed to the company’s growth rates the most.

Agrovetzashchita (AVZ) and Ekoprom were the best among the Russian manufacturing companies in the top 20, with the sales increasing 3.9 times and 3.2 times, respectably. AVZ’s the Four and a Tail repellents had the highest growth rates (sales grew 22.6 times), as well as the Bars products (2.6 times), mostly insectoacaricides. As for Ekoprom, the sales of its repellents contributed to the growth rates the most as well, namely Chistotel (sales increased 9.6 times) and Greenfort (9.8 times).

Volume and growth rates of veterinary drug retail sales on Russian online marketplaces* in 2020–2021

Рус

Рус