Analysis of Intersections Occurring when Pharmacies Cooperate with More than One Pharmacy Association (Q1 – Q3 2020)

While working with pharmacy associations, manufacturing companies and therefore, customers of marketing activities will inevitably have to face the following issue: some pharmacies cooperate with more than one association, which leads to the duplication of sales in the accounting reports. That, in turn, leads to the problem of fair settlements with associations, which could then result in incorrect planning and accounting distortion between different departments, as well as bring complications when assigning tasks to medical representatives, etc.

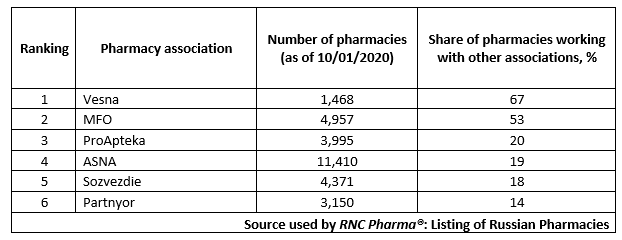

In Russia, pharmacies becoming a part of several different associations at once is very common and, due to the organizational specifics of individual companies, is far from controllable. In order to illustrate the problem, we chose six largest pharmacy associations in the Russian pharmaceutical market in terms of the total number of marketing contracts with manufacturing companies. Those associations are ASNA, Vesna, MFO, Parеnyor, ProApteka and Sozvezdie (in alphabetical order).

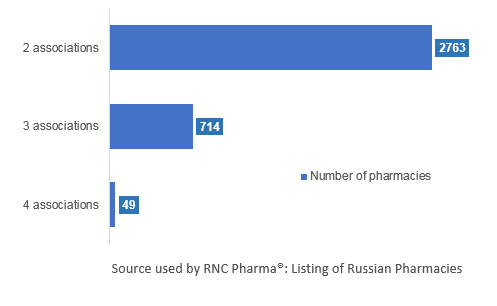

As of October 1, 2020, the total number of their partners is slightly less than 29.4 thousand pharmacies. Out of these, 2,763 pharmacies simultaneously belong to two associations, another 714 work with three associations at once, and 49 pharmacies are a part of four different associations (see Fig.).

Vesna has the largest number of intersections with other associations, as of Q1 – Q3 2020. Almost 67% of the pharmacies working with Vesna also cooperate with other organizations, the most popular of which is MFO (789 pharmacies work both with it and Vesna). MFO ranks second with 53%. Only 14% of the pharmacies that cooperate with Partnyor are also a part of other associations, with Sozvezdie being the most popular choice (384 pharmacies).

The most common intersection is ASNA / MFO (1,540 pharmacies), followed by the above-mentioned Vesna / MFO, and ProApteka / MFO comes third (623 pharmacies). The ASNA association is also worth mentioning, since it works with the largest number of pharmacies. However, only about 19% of the pharmacies belong to another association. As of October 1, 2020, no pharmacies work simultaneously with Partnyor and MFO.

There are several ways to achieve correct cooperation of the manufacturer with the pharmacy associations and solve the problem of intersections. For example, determine the priority of each association and count the sales according to the association’s priority. Or, make a list of pharmacies / TINs, which will be adjusted depending on the current contract, etc. Of course, this is only possible if the association operates openly and provides its marketing partners with transparent accounting reports. However, it is better not to cooperate at all with those who do not.

Read more about the analysis at the website of Farmatsevtichesky Vestnik: https://pharmvestnik.ru/content/news/Apteki-chasto-vhodyat-srazu-v-neskolko-marketingovyh-associacii.html?fbclid=IwAR2dv1XBIo9GNlQfkcDxTy0PXotajWey_Btf5gYMU8BqOKGMeMeAX7K-kis

Fig. Number of pharmacies working simultaneously with more than one pharmacy association (as of October 1, 2020)

Tab. Top pharmacy associations with the largest number of marketing contracts with manufacturers according to their share of pharmacies working with other associations

Рус

Рус