API Import to Russia (September and Q1–Q3 2022)

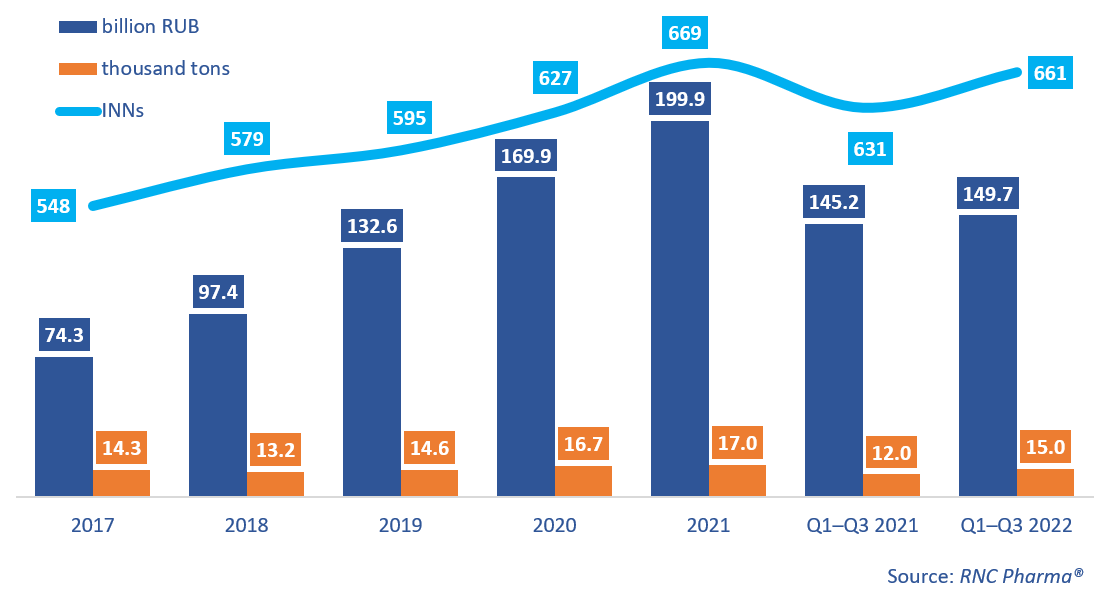

In January–September 2022, Russia imported 149.7 billion rubles’ worth of APIs (customs clearance and VAT included), up 3.1% from the same period last year. This is one of the lowest growth rates in the past 12 years—a lower growth rate, 1.3%, was seen only in 2016. In physical terms, the growth rate hit a record high—25%, with 15,000 tons of APIs imported.

The reason why the growth rates in monetary and physical terms were that different is deflation in the pharmaceutical market—the prices of APIs have been falling for several months in a row due to the Russian ruble revaluation, and the Laspeyres price index in January–September 2022 against January–September 2021 was –2.1%. In September 2022, it was as low as –11.4%.

In September 2022, Russia imported 15.4 billion rubles’ worth of APIs, down 13% from September 2021. In physical terms, the growth rate was 22% (against 83% in January 2022 and 73% in August 2022).

The number of imported INNs in January–September 2022 was 661, up 30 INNs from the same period last year. Among those 30 APIs that are no longer imported, fosamprenavir (imported by PSK Farma) and alteplase (by Boehringer Ingelheim) accounted for the largest import volumes in monetary terms. In physical terms, chlorhexidine (imported by three companies, with the Tula Pharmaceutical Plant accounting for the largest volume) and sodium lactate (Pharmvilar) were the most imported APIs.

Rivaroxaban had the best growth rates in January–September 2022—its imports grew 6.8 times against January–September 2021. While the import of rivaroxaban began back in 2019, it was trace amounts, which could hardly be used for production. This time, it was imported in much larger volumes from China and India and was bought by four companies at once, with the Berezovsky Pharmaceutical Plant accounting for the largest volume.

In physical terms, xylometazoline had the highest growth rate—its imports grew 597 times against January–September 2021. However, it was barely imported last year, and the import this year significantly exceeded those of the previous years, although still lower than in 2010 and in 2015. This year, the API was imported by six manufacturers, and Pharmastandard accounted for the largest volume.

Growth rates of pharmacopoeial and commercial API imports to Russia (EEU countries excluded), free circulation prices including customs clearance and VAT (2017–2021, Q1–Q3 2022)

Рус

Рус