Database Update: Veterinary Drug Retail Sales Audit in Russia (May 2020)

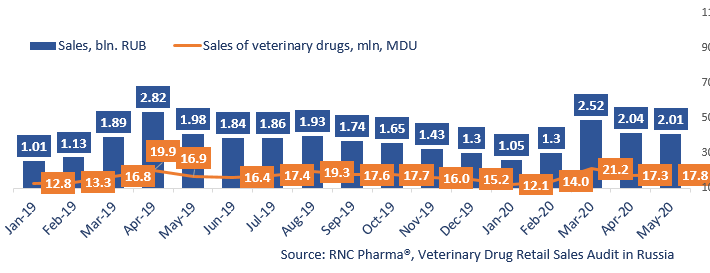

Between January and May 2020, the sales of veterinary drugs in the retail market amounted to 8.9 bln RUB (retail prices, VAT included). While the dynamics in monetary terms (rubles) are only +0.9%, sales got back to normal in May after April’s devastating results (the dynamics for the period between January and April were +0.6%). If calculated in minimum dosage units (MDU), the market volume is 82.4 mln MDUs, with the dynamics of +3.4%.

The fall in demand in April 2020 could be explained by two factors: first, the typical sales surge in April occurred in March because of the abnormally warm spring; second, demand was dictated by the coronavirus pandemic and the hype around it, hence their own health was the consumers’ first priority, leaving veterinary drugs behind. With the hype starting to die away in May 2020, the veterinary market could return to the way it had been before. The dynamics in May 2020 were +1.5% in rubles and +5.1% in MDUs.

Scientific&Production Company Issledovatelsky Tcentr has the highest dynamics among the top 30 manufacturing companies (its manufacture has grown by 4.5 times in monetary and by more than 7 times in physical terms). The company produces two veterinary trademarks: Vetom, products for the prevention and treatment of dysbacteriosis, and ointment Bioseptin. Vetom drugs were the ones that contributed to the dynamics the most. Scientific&Production Company Issledovatelsky Tcentr is followed by Agrobioprom, with the dynamics of +43% in monetary and +29% in physical terms. While, the company produces and sells two dozen veterinary trademarks, only the Pchelodar line (in particular, combined insectoacaricides for pets Pchelodar Binakar) and insectoacaricide for bees Varroadez contributed to the dynamics.

Vetoquinol has the best dynamics among the top 30 foreign companies (+44% in monetary and +340% in physical terms). Its antibiotic Clavaseptin (sales grown by 145 times), antimicrobial drug Oridermyl (+78%), and drug for renal failure Ipakitine (+76%) contributed to the dynamics. KRKA comes second, with the dynamics of +21% in monetary and +10% in physical terms. Anithelmintics Milprazon (+13%) and Dehinel (+18%) contributed to the company’s dynamics.

Fig. Volume and structure of Russian retail market of veterinary drugs (January 2019 – May 2020)

Рус

Рус