Database Update: Pharmaceutical Drug Import to Russia (March 2018)

Between January and March 2018, Russia imported 113.9 bln RUB worth of ready-made pharmaceutical drugs (free circulation prices), which is in monetary terms 0.2% higher than that of the same period of 2017, and 24.4 bln RUB worth of in-bulk pharmaceuticals, which is in monetary terms 18.5% higher than that of the same period of 2017. In total, the dynamics are 3%.

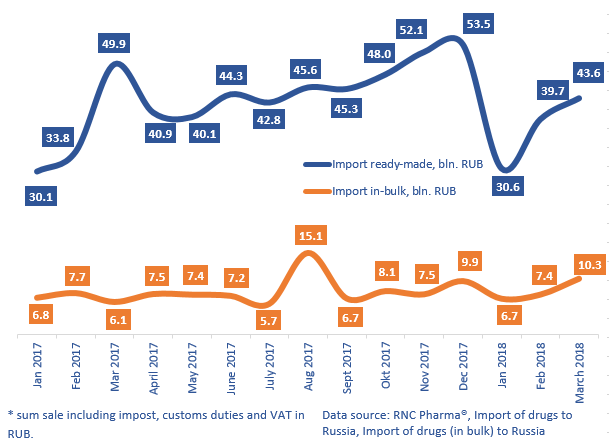

In March 2018, Russia imported 43.6 bln RUB worth of ready-made drugs (free circulation prices), which is in monetary terms 12.6% lower than that of March 2017 (lowest since March 2016), and 10.3 bln RUB worth of in-bulk drugs, which is 70.4% higher than that of March 2017. While the dynamics of the import of in-bulk drugs may seem spectacular, the dynamics were negative in January and February, which is compensated by the March results.

In physical terms, Russia imported 168.6 mln units of ready-made drugs, which is 13% lower than that of March 2017. If calculated in MDU (minimum dosage units), the dynamics are 0.9% for March and 0.2% for Q1 2018. However, thanks to the growing import of in-bulk drugs, the total dynamics for Q1 are 1.7%. The dynamics for the import of in-bulk drugs are 13.4% if calculated in MDU.

The leaders in the import of in-bulk pharmaceuticals in March are Sanofi and Merck Group. Sanofi has increased its import by more than 6 times over the year, thanks to Aubagio, Cerezyme, Toujeo, and Pentaxim. Merck Group has increased its import by nearly 3 times, thanks to Concor and Rebif.

Dynamics of import of pharmaceuticals, including homeopathic and seawater drugs, to Russia, free circulation prices including customs clearance and VAT, RUB (January 2017 – March 2018)

Рус

Рус