Database Update: Pharmaceutical Drug Production in Russia (March 2018)

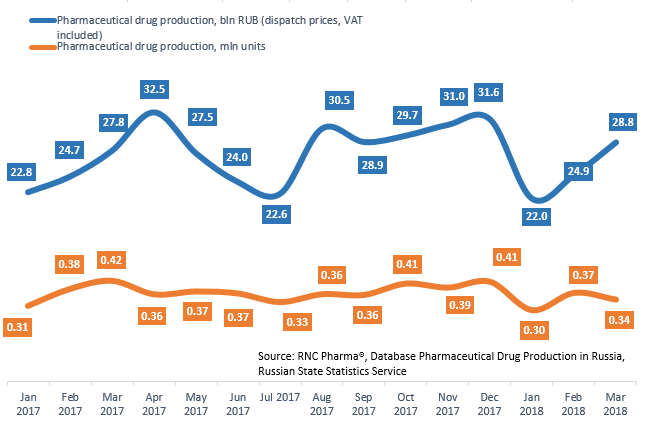

Between January and March 2018, Russia produced 75.7 bln RUB worth of pharmaceutical drugs (dispatch prices, VAT included), which is 0.5% higher than that of the same period of 2017. In physical terms, it is around 1.01 bln units, which is 10% lower than that of the same period of 2017.

We can see the negative dynamics both for over-the-counter and Rx drugs, with the over-the-counter drug production having fallen by 12.6% over the year. While the production of Rx drugs showed positive dynamics in February, it decreased by 5.6% in March. Among the top 10 EphMRA groups of second level that are leaders in physical terms, seven showed negative dynamics in March 2018. The following groups showed tworst dynamics: antivirals (-36%), neuroleptics (-26%), cold and cough medications (-22%) and painkillers (-21%.) This is obviously due to a relatively low incidence of influenza and ARVI at the beginning of the year, which has had a big influence on the season’s trends./p>

Among the top 10 companies, Pharmstandard and Tatkhimfarmpreparaty still show the worst dynamics, with -26% and 22%, respectively. Pharmastandard has considerably decreased the production of the popular Citramon (-60%), Acidum Ascorbinicum (-38%), and Corvalolunm (-37%.) However, the production of the promoted Complivit and Pentalgin has also fallen by 32% and 26%, respectively. Tatkhimfarmpreparaty has decreased the production of Cough Pills (-80%), Ortophenum (-41%), and Validol (-35%.) However, Pharmstandard has increased its production of Naphthyzin (by 4 times) and Pancreatinum (by 3.6 times), while Tatkhimfarmpreparaty has increased the production of Liquid Paraffin (by 3.5 times) and Ehrithromicin (by 3.3 times).

Dynamics of pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (units) and monetary terms (RUB, VAT included) (January 2017 – March 2018)

Рус

Рус