Pharmaceutical Drug Production in Russia (February 2022)

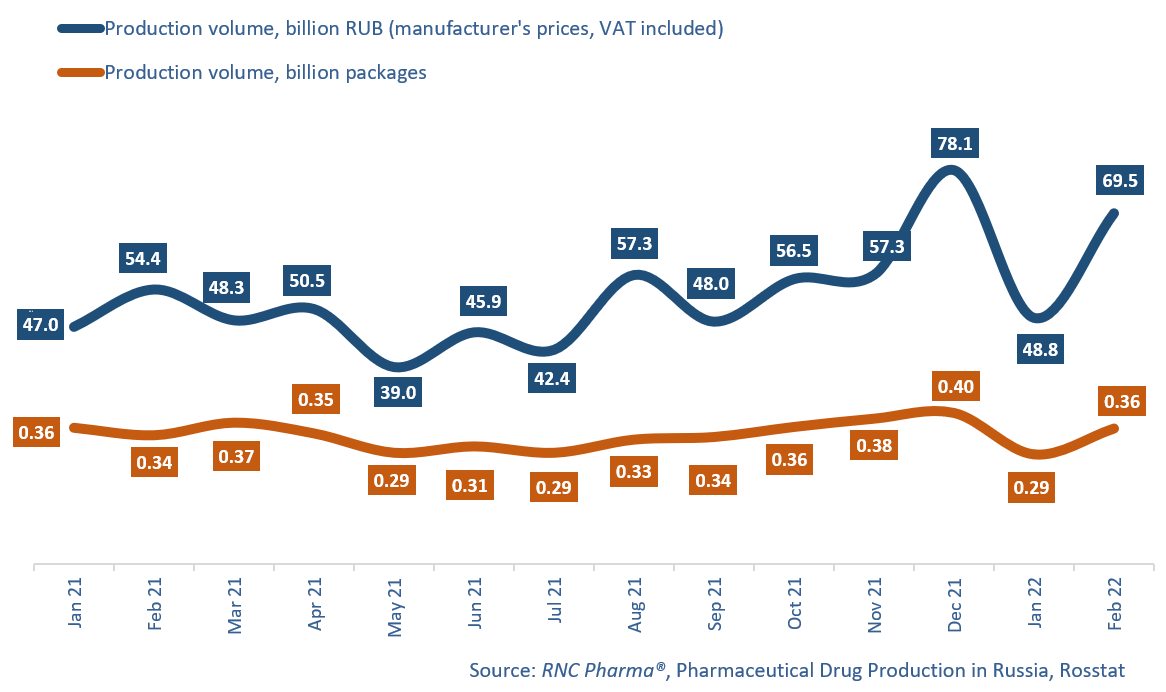

In January–February 2022, Russian manufacturers produced RUB 118.3 billion worth of pharmaceutical drugs (manufacturer’s prices, VAT included), up 16.7% from January–February 2021. The result is quite comparable to that in the same period in 2021, when the growth rate in monetary terms was 16.9%. However, the growth rates in early 2022 were far from even, with 3.8% in January and 27.8% in February.

In physical terms, the production volume in January–February 2022 was 0.65 billion packages, or 11.8 billion minimum dosage units (MDU). The growth rates were –7.5% in packages and –0.8% in MDUs. At the same time, the growth rate in packages was –19.4% in January and 5.2% in February.

The growth rates also varied depending on the type of drug. However, now the production of OTC drugs has better growth rates than that of Rx drugs, as opposed to before. The growth rates were –3.3% and –12.1% for OTC and Rx drugs, respectively. February was mainly responsible for this difference, when the growth rate of the production of OTC drugs was 18% and that of the Rx production was –8%. The growth rates in January, though, were more or less even.

Ruzpharma had the best growth rates in physical terms in January–February 2022 among the manufacturers of prescription drugs. Its manufacture grew 347 times against January–February 2021, with only Ceftriaxone contributing to the growth rates. However, that is a result of the low base effect as well as a significantly expanded production. In January 2021, the company produced only a few thousand packages of Ceftriaxone, halting production from February to March and resuming in April 2021. Ruzpharma is followed by Chemical Pharmaceutical Group Mir; its production increased 53 times. The company produces a bigger variety of drugs, manufacturing six brand names in January–February 2022, with injection forms of Lidocaine, Ketorolac and Novocaine contributing to the growth rates the most. Despite the growth rates, the company can hardly be called a newcomer, since it is another transformation of the Ekskom group in Stavropol.

As for the producers of OTC drugs, Vifiteh had the highest growth rates, increasing its manufacture more than 10 times against January–February 2021. At the same time, the company failed to make it to the top 20 in terms of production volume. Having a diverse product range, the company manufactured more than three dozen brand names in January–February 2022, with Mucaltin, Rotocan, and Propolis Tincture contributing to the growth rates the most. Vifiteh is followed by Bagrif; its production grew 5.4 times, with Motherwort, Hawthorn and Evasive Peony Tinctures contributing to the company’s growth rates. It is interesting that the company’s two-months’ worth production volume is comparable to that of the entire 2020.

Volumes of pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (packages) and monetary terms (RUB, VAT included) (January 2021–February 2022)

Рус

Рус