Database Update: Pharmacies Operating in Russia (December 2020)

As of January 1, 2021, a total of 67,296 pharmacies were operating in Russia. (Only pharmacies purchasing goods from distributors were counted.) Compared to January 1, 2020, the number has decreased by 1,539. The downward trend started back in April 2020, a clear impact of the COVID-19 outbreak in Russia, as well as the set of measures taken to stop the spread of the epidemic. Then the situation deteriorated due to general economic problems, including the decreasing incomes of the population, as well as the fact that it is no longer possible to impose UTII on labeled goods.

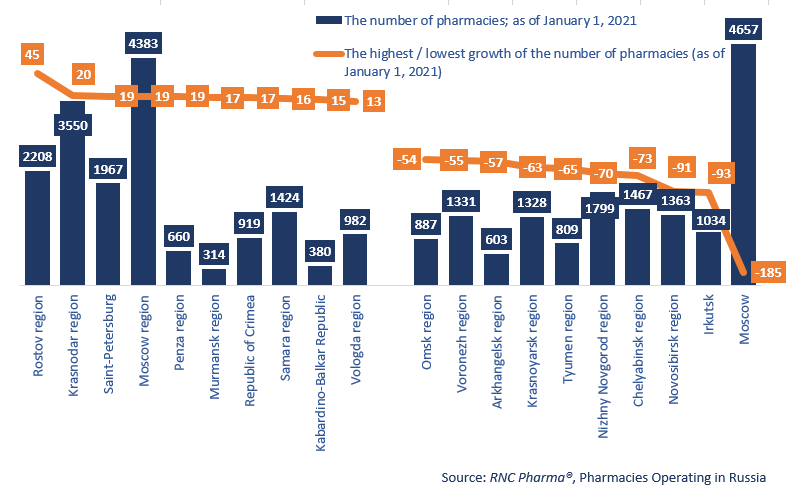

In 2020, the pharmacy infrastructure was developing mainly due to the segment of pharmacy chains; the number of pharmacies within chains increased by 2,521, totaling 52,118 at the beginning of 2021. The number of independent pharmacies has decreased by 4,060, and is now 15,178. Moscow has the largest number of pharmacies; as of January 1, 2021, 4,657 pharmacies were operating there. At the same time, Moscow saw the biggest number of pharmacies closing – 185. Mostly independent pharmacies closed, while the number of pharmacies belonging to a chain even increased (by 31). Of course, the situations with the chains were different, at least 35 of the 116 chains operating in the capital, by the end of 2020, closed more pharmacies than they opened. Stolichnye Apteki and Melodia Zdorovya had the biggest drops – by 18 and by 13, respectively.

The Irkutsk Region lost the second-largest number of pharmacies (-93). Most of the closed pharmacies did not belong to any chain, while the chains grew by 16 new. Implozia opened the largest number of pharmacies (+18), as well as the municipal chain Irkutskaya Apteka (+11).

The Moscow Region has the second-largest number of pharmacies – 4,383, as of January 1, 2021. The region is one of the leaders in terms of the development of the pharmacy infrastructure; the total number of pharmacies operating there increased by 19 in 2020. Once again, it was the chains structures that contributed to the development, with the chains opening 222 pharmacies and independent pharmacies losing 203. Rigla (+33), Planeta Zdorovo (+23) and Pharmacy Chain 36.6 (+22) are the chains with the biggest growth.

The Rostov Region saw the biggest growth in the number of pharmacies in 2020 (+45). The situation here is identical to that in the above-mentioned regions; the chains were noticeably ahead of independent pharmacies in terms of development. The Implozia and Aprel chains grew by as many as 35 pharmacies. They are followed by Magnit, which opened 18 new pharmacies in the Rostov Region and now includes 65 pharmacies.

Top 10 federal subjects of Russia with the highest / lowest growth of the number of pharmacies (as of January 1, 2021)

Рус

Рус