Database Update: Audit of Veterinary Drug Retail Sales in Russia (August 2021)

In January—August 2021, the sales of veterinary drugs in the Russian retail market amounted to 15 billion rubles (retail prices, VAT included), up 5.5% in monetary terms (rubles) from January—August 2020. The inflation rate is still the most important factor for the growth rates. In physical terms, the sales declined, and the growth rate in minimum dosage units (MDU) was 5.1%, with the sales volume of 116.1 million MDUs.

In addition to general economic problems, weather conditions affected the growth rates as well. While the spring saw more or less standard consumption trends, the end of summer was different both from summer 2020 and summer 2019. Sales surged in both monetary and physical terms in July 2021, but started to go back down again in late August. The growth rate in August 2020 was +9% in monetary (rubles) and -9% in physical terms (MDUs).

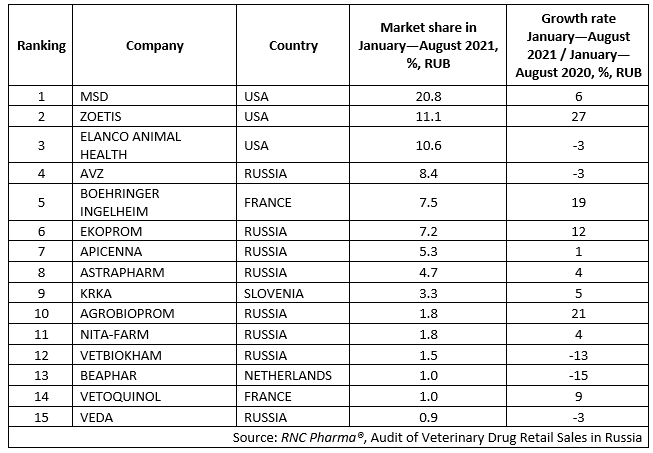

MSD had the largest sales volume in January—August 2021 among the top 15 manufacturers. While the company’s growth rates in monetary terms are hardly record-worthy, the sales here are growing even faster than the market’s average. Besides, this time it was Nobivac that contributed to the growth rates the most, not Bravecto; the sales of Nobivac vaccines grew by 19% over the year. MSD is followed by Zoetis, which has the highest sales growth rates of +27% in monetary terms. Insectoacaricide Simparica (+43% in rubles) and antibiotic Synulox (+36%) contributed to the company’s growth rates. Elanco comes third, with the sales volume decreasing by 3%. Note that the top 3 manufacturers are American companies.

Nevertheless, as many as 8 Russian manufacturers entered the top 15. Top 4 AVZ, however, has negative growth rates of -3%. The sales growth rate of its key product, Bars, is also -3% in monetary terms. Top 10 Agrobioprom has the highest growth rates of +21%, with its ear drops Otidez (+29%) and insectoacaricide Binakar (+19%) contributing to the growth rates. Ekoprom is also worth noting, with the growth rate of +12% thanks to the sales of Inspektor.

Dutch Beaphar (-15%) and Russian Vetbiokhim (-13%) have the lowest growth rates in the top 15. The decreasing sales of Beaphar insectoacaricidal collars determined the growth rates. As for Vetbiokhim, the line of vaccines for pets Multican stopped selling as well as before, with Multican 4 hit the hardest. The vaccine is used for the prevention of plague, adenovirus infections, parvovirus and coronavirus enteritis in dogs.

Top 15 manufacturing companies with the largest sales volumes in the Russian veterinary retail market in January—August 2021

Рус

Рус