Database Update: Import of Veterinary Drugs, Feed Supplements, and APIs to Russia (July 2019)

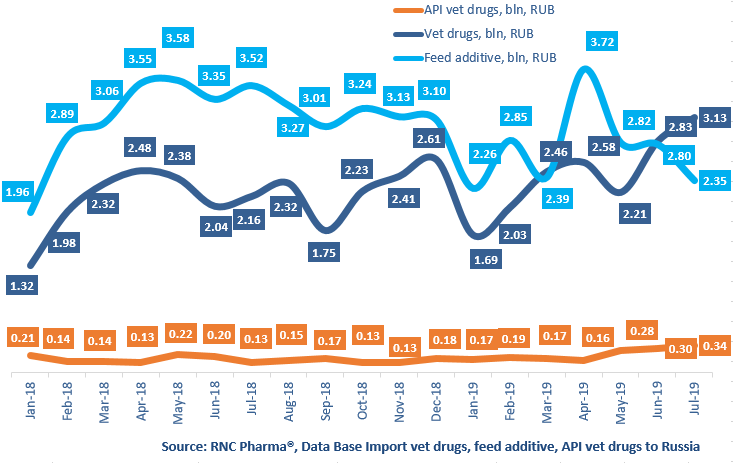

Between January and July 2019, Russia imported 37.7 bln RUB worth of veterinary products (free circulation prices, VAT included), which is in monetary terms (rubles) 0.1% lower than that of the same period in 2018. The negative dynamics are only due to the import of feed supplements dropping by 12.4%. However, the import of feed supplements is the leader in the volume of import in monetary terms with 19.2 bln RUB. The dynamics in physical terms (units) are only negative, -2.4%.

The dynamics of the import of veterinary drugs in monetary terms are +15.4%, with the import of 16.9 bln RUB, and the dynamics in physical terms are +27.2%, with the import of 19.9 mln units. The import of veterinary APIs is the absolute leader, with the dynamics of +36.8% in monetary terms and +33.5% in physical terms (kg), despite the import volume of 1.6 bln RUB, or 719 tons.

Among the manufacturers of feed supplements with the highest dynamics in monetary terms, Evonik is the leader, despite the total dynamics in monetary terms of +4%. Last year’s leader, Pt. Cheil Jedang, has lowered its import by 60% in monetary terms, placing third. In the top 20, Neovia Group is the leader, having increased their import by 2.5 times. The company imports 4 feed supplements to Russia, with V-Traxim Se accounting for the biggest percentage of the import.

As for veterinary drugs, Beaphar has the highest dynamics in the top 20, with a 4.6 times increase. The company is known for their antiparasitic products, with their collars accounting for the biggest percentage of the import. The import of Beaphar Collar S.O.S. has grown by 15.6 times in monetary terms. Boehringer Ingelheim has the lowest dynamics, -28%.

Among the top 20 manufacturers of veterinary APIs, Chinese Shengli Bioengineering (Shangdong) and Shenyang Antibiotic Manufacturer (Shenyang) have the highest dynamics in monetary terms, with 16.6 and 16 times increases, respectively.

Dynamics of import of veterinary drugs, feed supplements, and veterinary APIs to Russia, free circulation prices including customs clearance, bln RUB (January 2018 – July 2019)

Рус

Рус