Database Update: Audit of Veterinary Drug Retail Sales in Russia (July 2022)

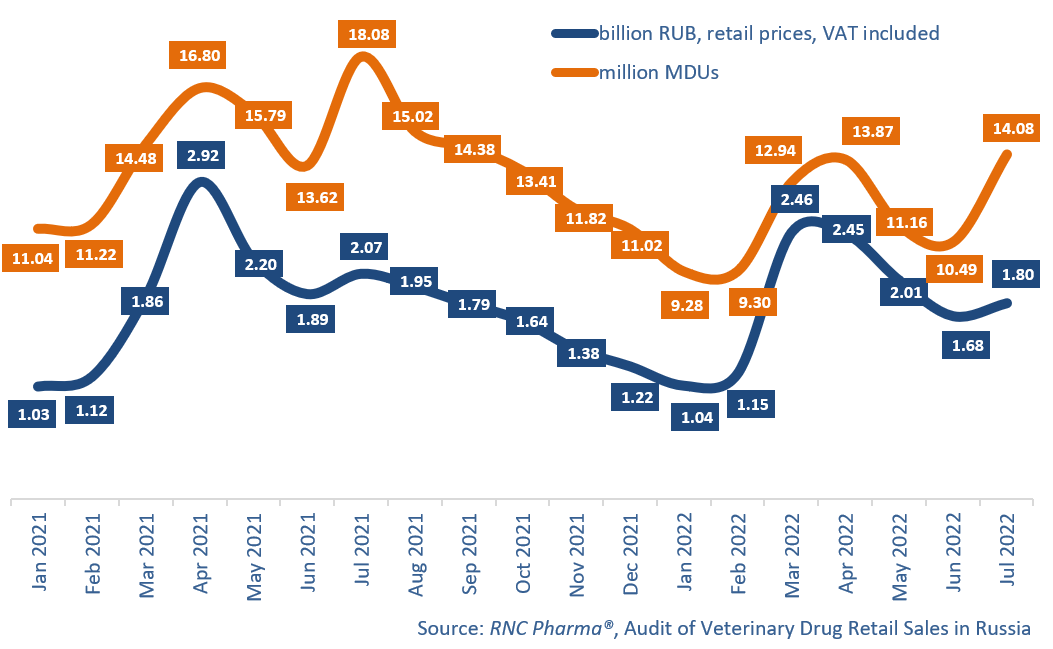

In January–July 2022, the retail sales of veterinary drugs in Russia amounted to 12.6 billion rubles (retail prices, VAT included), down 3.5% from the same period in 2021. In physical terms, the sales were 81.1 million minimum dosage units (MDU), down 19.7% from January–July 2021.

The negative growth rates were mostly due to low demand in July 2022. However, the market volume has been steadily going down since April, because, on the one hand, consumers have been using up what they stocked up on back in March 2022 and, on the other hand, household incomes have dropped. Besides, demand is affected by the fact that the online channel has been attracting consumers from the offline segment. The sales of veterinary drugs in July 2022 were 1.8 billion rubles, 13% down from July 2021. In physical terms, the sales were 14.1 million MDUs, down 22% compared to July 2021. At the same time, compared to June 2022, the sales grew by 7.1% in rubles and by 34.2% in MDUs—a direct result of the weather conditions in a number of Central Russia regions, which could, too, be an anomaly of sorts.

KRKA had the best growth rates (+40%) among the 20 companies with the largest sales volumes in monetary terms in January–July 2022. The sales of its antiparasitic drug Selafort doubled, contributing to the company’s growth rates the most, and the sales of Otoxolan, a drug for otitis, grew 14.6 times against January–July 2021. KRKA is followed by Livisto Group (+27%), with antibiotic Doxifin and anti-inflammatory Petkam contributing to the growth rates (sales grew 2.2 times and 51%, respectively). Among the companies outside the top 20, Russian Vetfarm is a worthy mention—its sales increased 3.2 times against January–July 2021, and Otibiovet, a combined drug for otitis in pets, helped the company’s growth rates.

As for the top 20 companies with the largest sales growth rates in physical terms, Russian Askont+ had the highest growth rates—its sales grew 2.1 times against January–July 2021, with antimicrobial and antiprotozoal drug Metronidazole contributing to the growth rates the most (sales grew 6 times). Outside the top 20, the sales of another Russian company, Probiopharm, increased 3.8 times against January–July 2021. The company’s retail portfolio is still relatively modest, which is why only one product, Zoonorm, bifidobacteria sorbed on activated carbon, could contribute to the growth rates, which is.

The volume of the Russian retail market of veterinary drugs (online sales excluded) in monetary and physical terms (January 2021–July 2022)

Рус

Рус