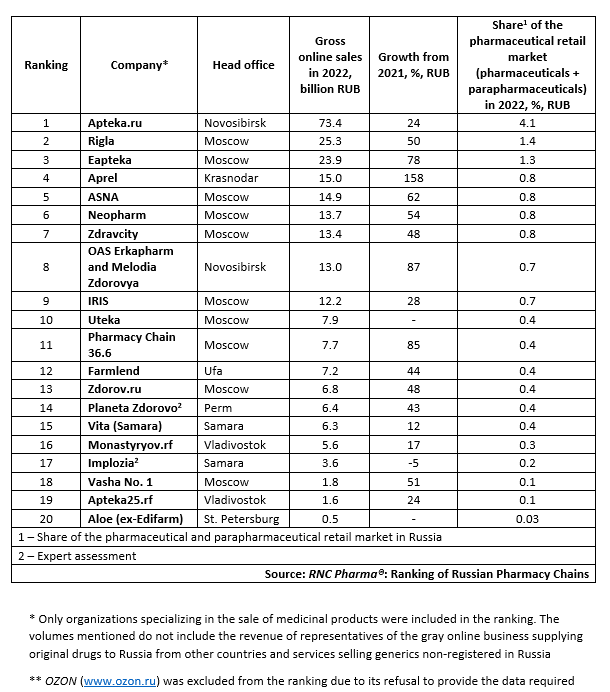

Top 20 Online Pharmaceutical Retailers in Russia in 2022

In 2022, the online sales or reservations of pharmaceutical products (pharmaceutical drugs and parapharmaceuticals) in Russia were 294.6 billion rubles (end-user prices, VAT included), 40.3% up from 2021, when the growth rate was 53%. Interestingly, the growth rates varied from quarter to quarter; the sales went up nearly 70% back in Q1, while they grew by only 18.7% in Q4.

The slowdown by the end of the year can be explained by a number of factors, including a general decrease in demand due to falling household incomes and a decrease and redistribution of promotion by manufacturers. At the same time, a number of market players, both aggregators and large pharmacy chains, have obviously lost interest in investing in the segment. Many had high hopes for the online sales of prescription drugs, but when the requirements were announced, it became clear that a quick launch of full-scale activity could not be expected soon. The pilot project, which was only formally launched on March 1, 2023, was faced with a number of administrative issues in the regions. In such circumstances, investing in the online segment might not seem like a top priority. Still, market players will definitely be participating in the pilot project.

Online sales accounted for as much as 16.5% of the total sales in the Russian pharmaceutical market in 2022, because the online segment had nearly thrice the growth rates of the offline channel. The revenue of the top 20 companies was 260.5 billion rubles (end-user prices, VAT included), accounting for around 88.4% of the online revenue in the pharmaceutical market. In addition, the average figures of the top 20 companies were higher than those in the market.

Yet, the growth rates of the top companies were already much more modest than in 2021. Only the sales of Aprel increased many-fold (2.6 times against 2021), although that was primarily the result of active expansive development—in 2022, the chain grew by more than 2,300 pharmacies, a pace comparable to that of pharmacy associations. As for associations, the growth rates of its members can no longer provide such high growth rates of online sales. The online sales of Apteka.ru went up 24%, those of Zdravcity increased 48%, and ASNA 62%. While all these companies grew in number significantly last year, there was no direct correlation between the number of pharmacies and growth rates. In addition, after a very active development last spring and summer, an unrestrained growth of infrastructure was no longer a trend in the fall and winter. Apteka.ru, for example, even lost several hundred organizations in Q4. Implozia had the worst growth rates among the top 20 companies—its turnover went down 5% from 2021 in rubles.

Тop 20 Russian pharmacy chains and pharmaceutical associations with the largest online sales in 2022**

Рус

Рус