Database Update: Audit of Veterinary Drug Retail Sales in Russia (June and Q1–Q2 2021)

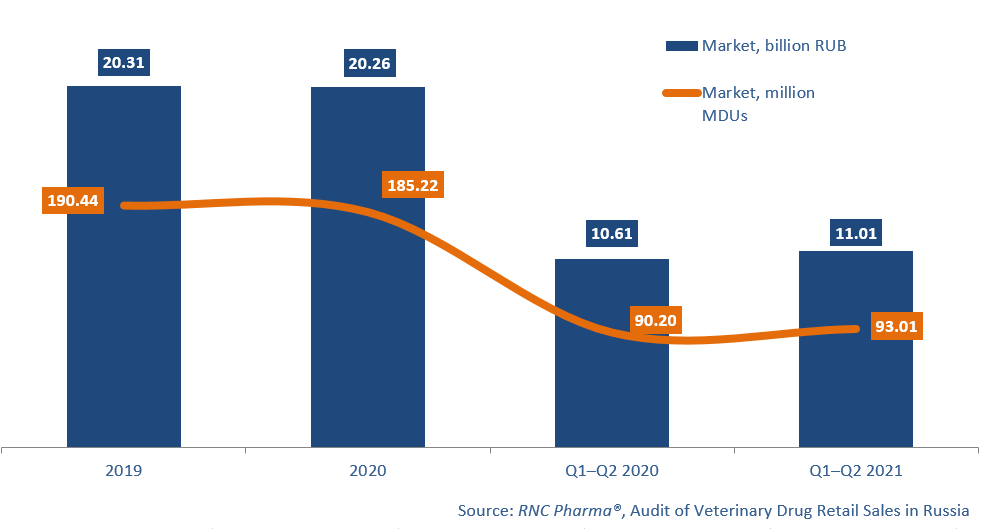

Between Q1 and Q2 2021, the sales of veterinary drugs in the Russian retail market amounted to 11 billion rubles (retail prices, VAT included), up only 3.8% in monetary terms (rubles) from 2020, which is much lower than the inflation rate of 8.3%. In physical terms, the market volume amounted to 93 million minimum dosage units (MDU), with the growth rates of +3.1%.

After the rapid growth in April and May 2021, a calm period, the so-called low season, came in June, when the demand for the most popular pharmacotherapeutic groups naturally decreased. The growth rates in June 2021 were +1.8% in monetary and -11.8% in physical terms. To be fair, these are far from the worst results of the first six months of 2021; the growth rates were much lower in February and March, but that was due to atypical climatic conditions in early 2021, which lead to a shift of the peak season. Now it is the economic situation that has a significant impact on the demand.

Manufacturers from 29 countries were selling veterinary products in Russia in Q1–Q2 2021, with the US companies accounting for 38.1% of the market in monetary (+1.6%) and around 17.4% in physical terms (+0.6%). MSD had the largest sales volume among the American companies, with the growth rates of +3.2% (in rubles) and -0.3% (in MDUs). Zoetis had the best growth rates of +23% and +10.3% (in monetary and physical terms, respectively). Insectoacaricide Simparica (+39% in rubles) and antibiotic Synulox (+34%) contributed to the growth rates the most. Euracon Pharma (Germany) still has the best growth rates among the foreign companies; its sales increased 14 times in monetary terms over the year. This year, the company was selling only one product in Russia – anthelminthic Caniquantel.

The Russian veterinary manufacturers had the largest sales volumes, accounting for 65.5% of the market in physical terms. However, the total share of the Russian companies decreased by 0.3% in physical and 1.8% in monetary terms (from 33.8% to 32%). Only 6 companies in the top 15 had positive growth rates, with Agrobioprom and Askont+ having the highest ones (+23% and +17% in monetary terms, respectively). Eardrops Otidez and insectoacaricide Binakar contributed to the growth rates of Agrobioprom (+30% and +25%, respectively). As for Askont+, its growth rates were positive due to the sales of Gabivit-SE (increased 2.2 times over the year), Butastim (2 times) and Eleovit (+35%).

The volume of the Russian retail market of veterinary drugs in monetary (end user prices, VAT included) and physical (MDU) terms (2019–2020, Q1–Q2 2021)

Рус

Рус