Ranking of Russian Pharmaceutical Chains (Q1–Q2 2022)

While the pharmaceutical retail quickly returned to its usual state after the March rush demand, the crisis could not go without a trace. The market is still experiencing certain problems here and there, and suppliers have begun to review the effectiveness of product portfolios. To be fair, this does not mean that portfolios have been getting smaller—quite the opposite, the portfolios of Russian companies have been actively growing. However, foreign manufacturers have significantly shortened their SKU lists—apparently, this process was in full swing in mid-summer. Nevertheless, the market does not seem to be experiencing any global problems with liquidity, with forecasts looking promising.

As for the online sale of prescription drugs, the situation seems more certain now, although it is rather difficult to say this is positive. Obviously, the process is being dragged out, and the option that could give momentum to the development of the online retail on a federal scale is at least 3.5 years late. While the pilot sale is planned in some regions, it is still very difficult to call it a global victory.

Meanwhile, the Russian pharmaceutical retail could use a boost in growth rates, since the second half of 2022 may turn out to be a very difficult period for the industry, especially in terms of demand. Real household incomes dropped 0.8% in Q1–Q2 2022, a normal result, given the number of sanctions placed on the Russian economy. But the problem is that the crisis is sure to have delayed consequences, especially since one-time payments that employees of certain companies receive upon dismissal can make the current situation seem better, but only at first sight. Lump sum payments in the amount of 4–8 salaries are more likely to be put on deposit or spent on durable goods, not on daily needs. Yet, future employment is not guaranteed; IKEA alone will leave up to 10,000 people unemployed, and restarting such industry giants proved to be a daunting task, take Vkusno i Tochka for example.

Against this background, the number of pharmacies in Russia has begun to decline. As of July 1, 2022, Russia had 71,981 pharmacies, 275 less than three months earlier. This decline is far from significant, especially since it is summer, when many people are busy with repairs, relocations, etc. Still, the last time this number went down was about 20 months ago as a result of COVID restrictions.

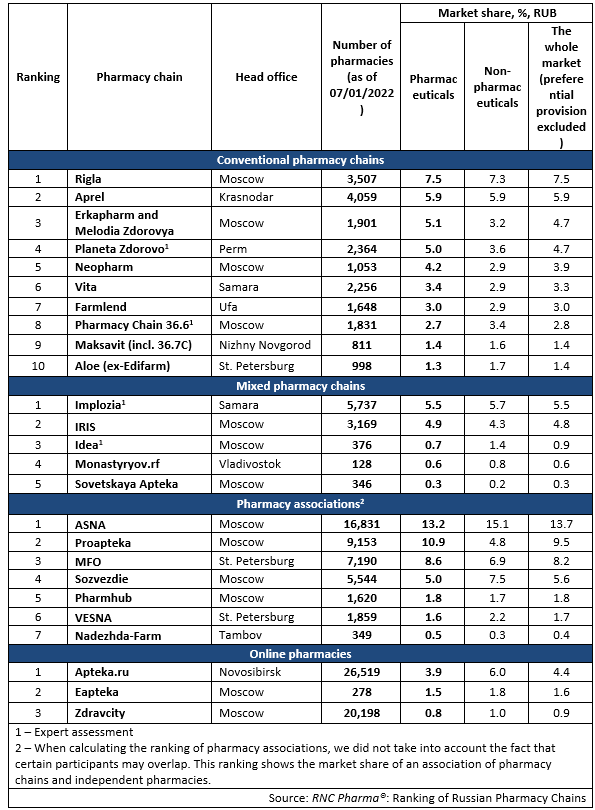

Tab. Top pharmacy chains in the Russian pharmaceutical retail market (Q1–Q2 2022)

Рус

Рус