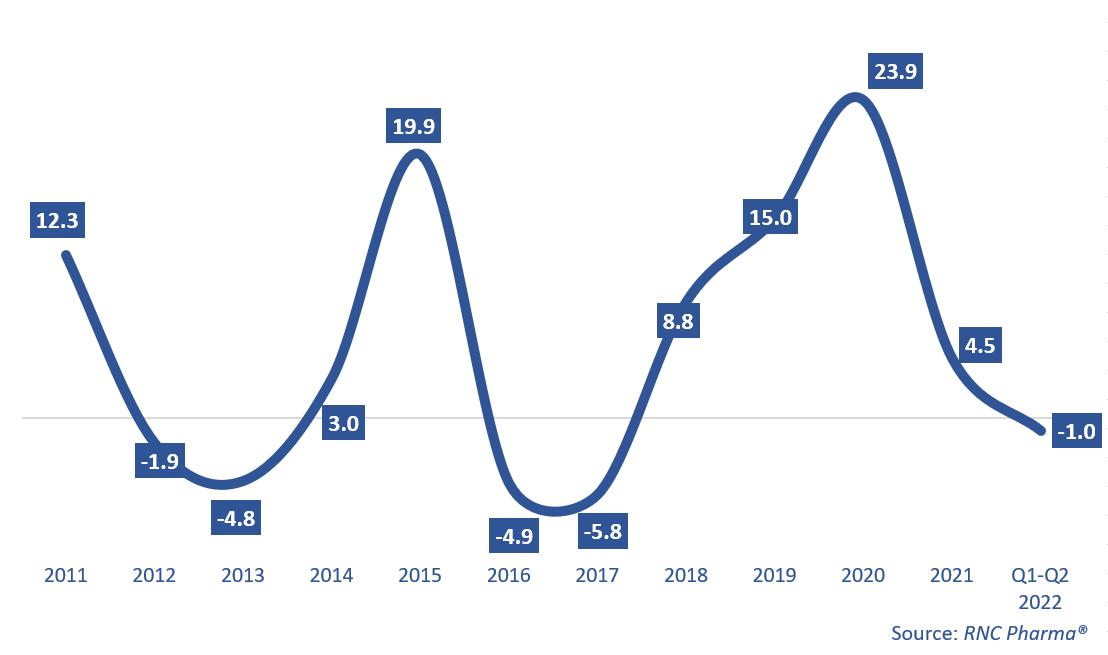

Inflation Rate for APIs Imported to Russia in 2011–2021 and Q1–Q2 2022

The Laspeyres price index for APIs imported to Russia in Q1–Q2 2022 was –1%, marking the first time in the past 5 years that the prices for foreign APIs have been declining. Besides, this is only the fifth deflation in the past 12 years, the last time dating back to 2017. After that, in 2018–2020, the Russian market witnessed a galloping inflation. In late 2020, the inflation rate hit a historic high, when the pandemic stopped API production in China and the prices jumped by nearly 24%.

However, the situation returned to normal rather quickly, and at the end of 2021, the price index for foreign APIs imported to Russia was a relatively modest 4.5%, which could be deemed a success against the general inflation of 8.4%. This year, the API market is undergoing much more serious changes than those associated with COVID-19. The special military operation prompted a significant number of API importers to make radical changes to their supply chains, which increases prices as it is. At the same time, imports from certain regions, for example India, have been dropping. Some importers even stopped working with Russia—luckily, those are modest companies that do not supply unique products.

Deflation might look strange in this case, but could be explained by the situation in the foreign exchange market. Even if the official exchange rate of the ruble against the dollar and the euro is somewhat “virtual”, the Russian ruble really has strengthened significantly over the past few months, which affects the value of contracts in foreign currency—they accounted for 83.4% of the total imported tonnage in Q1–Q2 2022. While the share of the ruble has grown significantly over the year (against 13.8% in 2021), this does not change the situation that much, making exchange rate fluctuations a key factor in determining the final price, even if other overhead expenses increase. Notably, the volume of transactions in Chinese yuans has more than quadrupled over. While the yuan accounts for a relatively small share of imports in tons—8.7%, given the way the world economy is heading, the yuan is very likely to become a more popular contract currency in the pharmaceutical market.

The ruble is mainly used to pay for APIs imported in the interests of foreign companies localized in Russia. At the same time, it is no secret to anyone that those contracts are seriously overvalued, sometimes ten times against the market price, which is an obvious tool for optimizing tax deductions in the country. However, the prices for APIs imported for Russian factories belonging to foreign companies went down 2.2% against 0.1% in the whole market.

Laspeyres price index for APIs imported to Russia in 2011–2021 and Q1 2022, %, RUB

Рус

Рус