RNC Pharma: B.Well Digital Thermometers Top the Ranking in Q1 2024

In Q1 2024, 2.76 million medical thermometers worth 949.2 million rubles (retail prices, VAT included) were sold on the Russian retail market (online sales included), up 8.2% and 7.1% from Q1 2023 in monetary and physical terms, respectively. Offline sales went up 7.7% in rubles and up 5% in units, while online sales grew 11.4% in rubles and 7.4% in units.

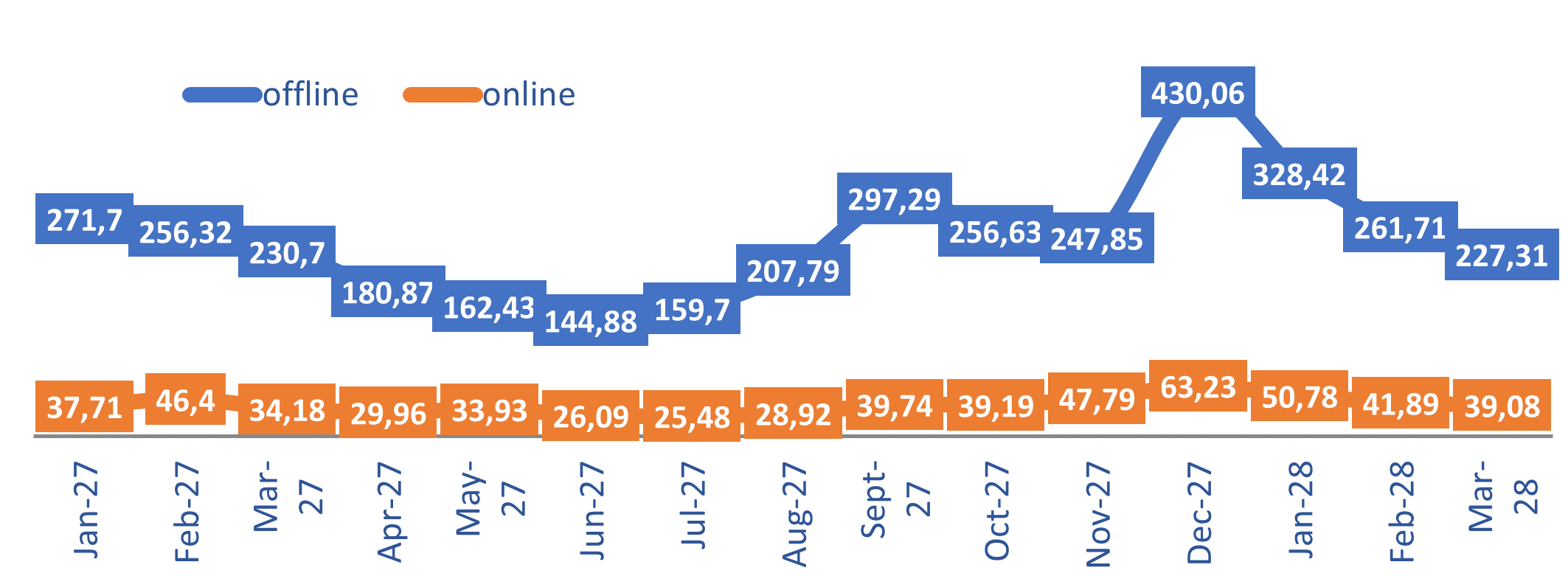

The seasonality of both online and offline markets means larger sales in the fall and winter. In December 2023, 1.4 million thermometers worth 493 million rubles were sold, with 430 million rubles accounting for offline sales. In early 2024, as usual, the demand started to decrease; 760,000 devices worth 266 million rubles were sold in March 2024. The first three months of 2024 saw a decrease in the demand for digital and mercury-free thermometers—down 1.9% and 9.6%, respectively. At the same time, the demand for mercury and infrared devices grew by 29.8% and 29.6% in physical terms, respectively. In monetary terms, the demand for both types of devices increased as well, going up 18.4% for mercury thermometers and up 20.7% for infrared devices.

Interestingly, infrared thermometers account for only 4% of the sales in physical terms, while digital and mercury devices account for more than 37% each. At the same time, the share of digital thermometers went down from 40.8% in January–March 2023, while the share of mercury devices went up 5.5%.

In Q1 2024, Swiss B.Well was the leader in the sales of digital thermometers, including infrared devices, in monetary terms, accounting for more than 31% of the sales (up 56% from Q1 2023). B.Well is followed by last year’s leader, A&D (Japan), with 17.2%. The sales of the Japanese company fell 22% from Q1 2023.

Singaporean Little Doctor had the best growth rates—its sales increased 59%, helping the company reach fourth place. If the company keeps up its growth rates, it can easily reach third place by the end of 2024. Swiss Microlife and Taiwanese Vega Technologies had the broadest product ranges, with 19 and 15 models, respectively. In Russia, both companies sell digital and infrared thermometers.

As for analog thermometers, most products on the market are unbranded, accounting for about 65.6% of the sales. Among brands, British Meridian Medical Products sold the most, followed by Russian Termopribor. The sales of both companies went up—by 85.7% and by 34.4%, respectively. Apexmed saw the highest growth rates—its sales of analog thermometers more than tripled from Q1 2023.

Monthly growth rates of the Russian medical thermometer market (offline / online) in January 2023–March 2024 (retail prices, VAT included)(online / offline)

Рус

Рус