Rating of Banks Performing Payment Transactions of Russian Import of Pharmaceutical Drugs (Q1 2015)

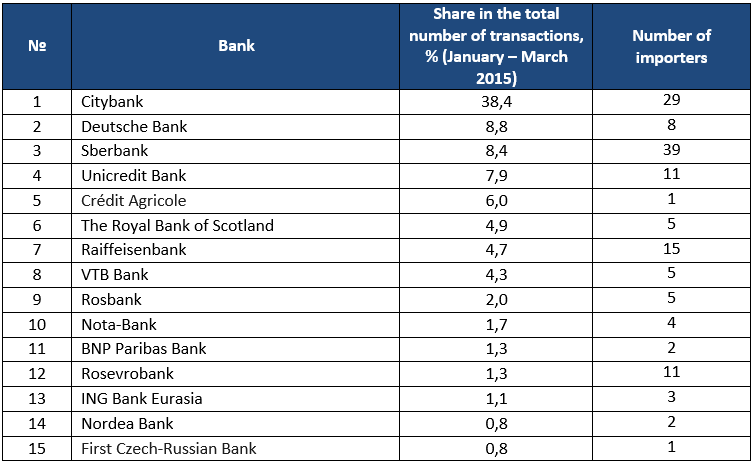

Nearly 70 banks perform payment transactions of the import of pharmaceutical drugs to Russia, with the top-5 banks performing 69.4% of all the transactions made in the first quarter of 2015. The absolute leader is Citybank, performing 38.4% of the transactions in monetary terms. It is followed by Deutsche Bank and Sberbank.

Sberbank is also the absolute leader in the number of importers they work with (39 companies in Q1 2015). Certain banks work only with one pharmaceutical company, for example, Crédit Agricole and First Czech-Russian Bank cooperate with Aventis Pharma and Prom. Medik. Rus., respectively. However, as of Q1 2015, Aventis Pharma works with two banks.

Top-15 banks performing payment transactions of Russian import of ready-made pharmaceutical drugs, in monetary terms (Q1 2015)

Рус

Рус