RNC Pharma: Active Development of Marketplaces Stimulates Logistics Market, Leads to Higher Wages and Tariffs

Last year, Russia saw the construction and commissioning of warehouse facilities slow down significantly, a result of the increased key rate leading to a higher cost of credit resources. Companies practically stopped building facilities with subsequent leasing due to significantly longer payback periods. Investors started switching to projects with a shorter investment cycle, primarily commercial real estate, hotel construction, etc. As a result, rental rates increased, reaching an all-time-high in late 2023.

At the same time, demand in the pharmaceutical market more or less stabilized and then started to grow rapidly again in 2024, increasing warehouse capacity utilization. The international logistic issues add up to the difficulties as well, since longer delivery times from abroad require more storage space to ensure stable supplies in the Russian market. As a result, vacant storage space is close to none. The situation in the pharmaceutical market is slightly better, with 5–10% in the off-season, while it is almost none in the peak season.

The active development of marketplaces is a huge incentive for the market, since the e-com segment requires both personnel and vacant storage space to keep up with the current growth rates. At the same time, e-com is in an active investment phase and, to continue developing, practices labor piracy with significantly larger wages. Labor piracy concerns both middle management and line personnel; as a result, logistics operators are also forced to increase their payroll costs, which leads to higher warehouse operation tariffs.

The situation seems unlikely to improve in 2024–2025, with the key rate increased to 18% at the end of July and continuously worsening staffing issues. Storage problems are most likely to aggravate, and manufacturers and wholesale companies will have to either build their own warehouse facilities or seek outsourcing warehousing from those operators who still have available storage space or the ability to redistribute warehouse capacity between clients.

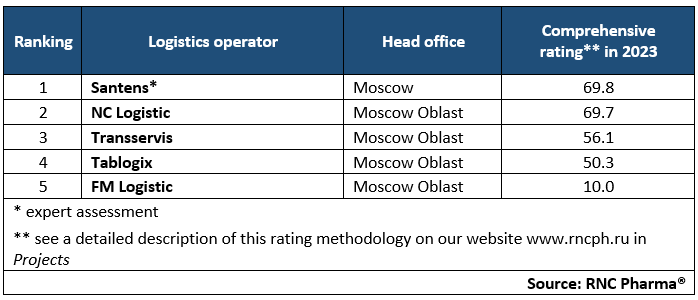

Santens and NC Logistic were the main competitors in 2023. Both companies have comparable infrastructure and client count. At the same time, NC Logistic is ahead of its competitors in terms of storage facilities and pallet positions. Still, Santens’ comprehensive rating is only 0.1% higher than that of NC Logistic (rank 1 in 2022). Transservis, a subsidiary of the Protek distributor, ranked third, with the largest number of partners, nearly all of them pharmaceutical companies.

Tab. Rankings of logistics operators in the Russian pharmaceutical market in 2023

Рус

Рус