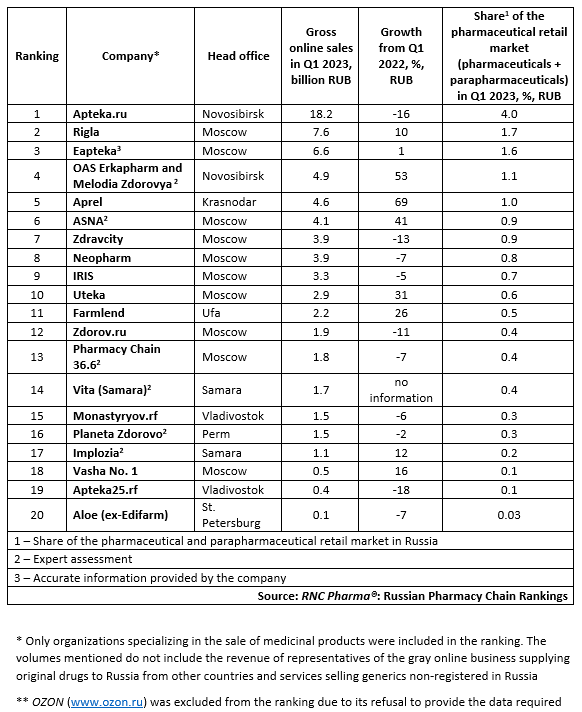

Top 20 Online Pharmaceutical Retailers in Russia in Q1 2023

In January–March 2023, the online sales or reservations of pharmacy products (pharmaceutical drugs and parapharmaceuticals) in Russia were 80.2 billion rubles (end-user prices, VAT included), up 2.3% from January–March 2022 (against 69.6% in Q1 2022, with its rush demand). This year, however, the online segment has entered a phase of stagnation due to the fact that further development might no longer be possible, when the experimental online sale of prescription drugs launched on March 1, 2023 is stalling.

Since potential problems with the launch were clear well before the start, certain market participants refocused their efforts on types of development with clearer prospects, stopping investments in its online channels. As a result, the sales of more than half of the top e-commerce companies dropped in the analyzed period. However, the total share of the online segment in 2023 still managed to go up to 17.7% (in rubles), thanks to the relatively low offline activity, not because of successful online work. The offline sales decreased 7.8% from Q1 2022, and the total retail sales of pharmaceuticals in Russia, including parapharmaceuticals, dropped 6.2%.

The revenue of the top 20 companies in Q1 2023 was 71.4 billion rubles (end-user prices, VAT included), accounting for around 89% of the revenue in the pharmaceutical market. Market concentration grew by nearly 3%, meaning that companies outside the top 20 saw low growth rates. (While some large businesses still invest in the online channel, many of the smaller ones can only dream of development because of the current restrictions regarding assortment.)

Aprel had the best growth rates among the top 20 companies—its online sales grew 69% from Q1 2022. First, Aprel has been opening new pharmacies at a tremendous pace (the number increased by 449 in January–March 2023). Second, it has been actively developing infrastructure, in particular, distribution centers. Aprel is followed by the Erkapharm and Melodia Zdorovya association (+53%)—interestingly, Katren completed bought out the business in early June and now owns 100% of the company. Meanwhile, the change in the management model of the association is in full swing, which should have a positive impact on the future development of the company’s online channel, since there is still a lot of potential for further development. ASNA (+41%), Uteka (+31%), and Farmlend (+26%) have high growth rates as well.

Quite a few top companies saw their sales go down in the analyzed period—Apteka.ru’s sales fell by 16% and Zdravcity’s by 13%. However, the two companies experienced rush demand last March. Apteka25.rf, a company based in Vladivostok, had the worst growth rates among the top 20 companies—its sales decreased 18%. Among other large companies that had to experience negative growth rates were Neopharm (–7%), Pharmacy Chain 36.6 (–7%), and Zdorov.ru (–11%).

Тop 20 Russian pharmacy chains and pharmaceutical associations with the largest online sales in Q1 2023**

Рус

Рус