Database Update: Veterinary Drug Retail Sales Audit in Russia (October 2019)

The Russia market of veterinary products consists of two main segments: households’ purchases and agricultural complexes and farms’ purchases. The volume of households’ purchases amounted to 18.1 bln RUB (retail prices, VAT included) in October 2019. Pet medicines account for 92% of the volume in monetary terms, while livestock medicines – for around 8%.

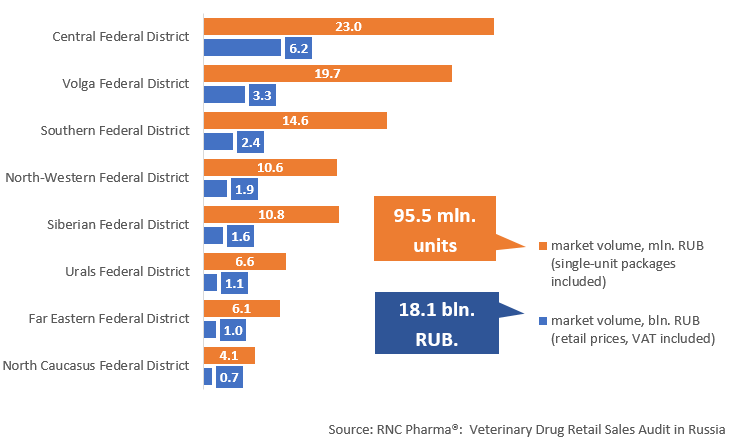

The volume of purchases in physical terms are 95.5 mln units, but the consumer packaging is not as various as that in the pharmaceutical market, and a significant number of veterinary products (around 27% of the volume in monetary terms) are sold in single-unit packages. There are 270 medicines of various pharmaceutical groups sold in singe-unit packages. The Nobivac vaccines by MSD and antihelminthic Milbemax by Eli Lilly are the leaders in volume. Among the regions, the Central Federal District is the leader with 34% of the volume in monetary and 24% of the volume in physical terms. The Central Federal District is followed by the Volga Federal District, with 18.4% in monetary and 20.7% in physical terms.

The volume of veterinary drug sales (3.2 bln RUB) in Moscow is close to that in the Volga Federal District (3.3 bln RUB). However, the medicines on the local markets are vastly different. The average prices are also different; the highest average prices were registered in the Central Federal District (270 RUB), and the Siberian Federal District and the Far Eastern Federal District had the lowest prices, with 146 and 157 RUB, respectively. Apart from Moscow and the Moscow Region, the maximum average price was also registered in Nizhny Novgorod (297 RUB) and Krasnoyarsk (283 RUB).

This year, there are 182 manufacturing companies in the household segment, with 92 Russian ones. The Russian manufacturing companies account for 37% of the market in monetary terms and 60% in physical terms.

MSD is the absolute leader, with 17.8% in monetary and around 6.1% in physical terms. The company is represented by 28 trademarks in the market, and their ectoparasiticide Bravecto accounts for 67% of the company’s sales. MSD is followed by Agrovetzashchita, with 8.9% of the market in monetary and 18.5% in physical terms. The company is represented by 61 trademarks, and the Bars line preparations account for 49% of the company’s sales in monetary terms. The Bars line includes insectoacaricides, ectoparasiticides and antibacterials (in particular, eye and ear drops).

The volume of Russian households’ purchases of veterinary drugs, by Federal Districts, January — October 2019

Рус

Рус