Inflation Rates in the Russian Pharmaceutical Retail Market (March 2024)

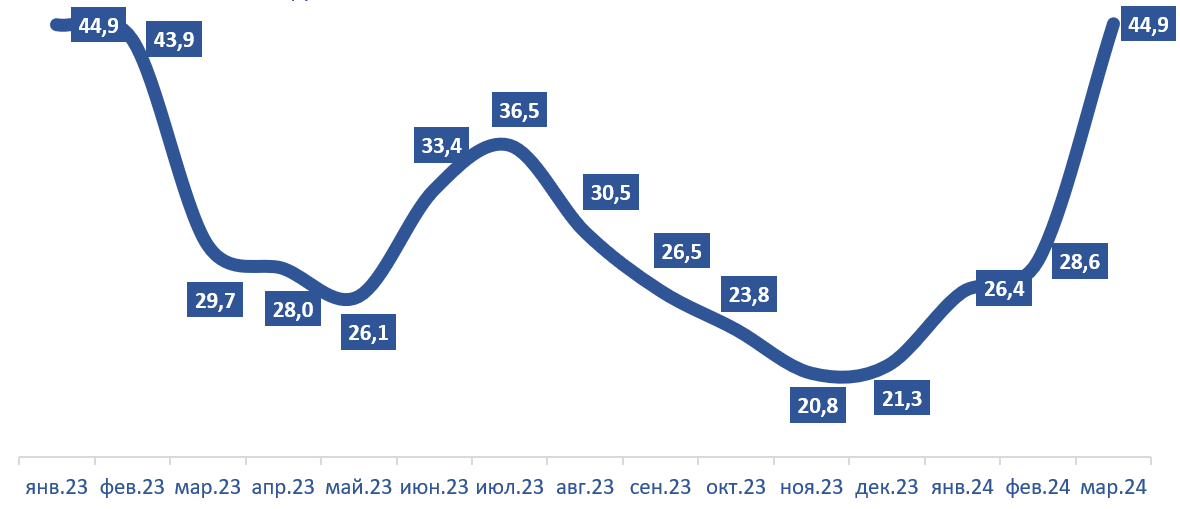

In 2023, veterinary drugs on the Russian retail market (e-com included) went up in price 26.6% from 2022. The highest price growth rates were seen in early 2023 (Fig. 1); as a result of the devaluation of the ruble and the subsequent correction of prices for imported goods on the Russian market, inflation surged in June–August 2023. By the end of the year, the prices had stabilized, dropping to a year-low. January and February 2024, however, saw an upward trend (26.4% and 28.6%, respectively), which peaked in March 2024 with 44.9%, going back to last year’s index. In January–March 2024, the price index was 34.7%.

Fig. 1. Inflation rates* in the veterinary retail market in January 2023–March 2024

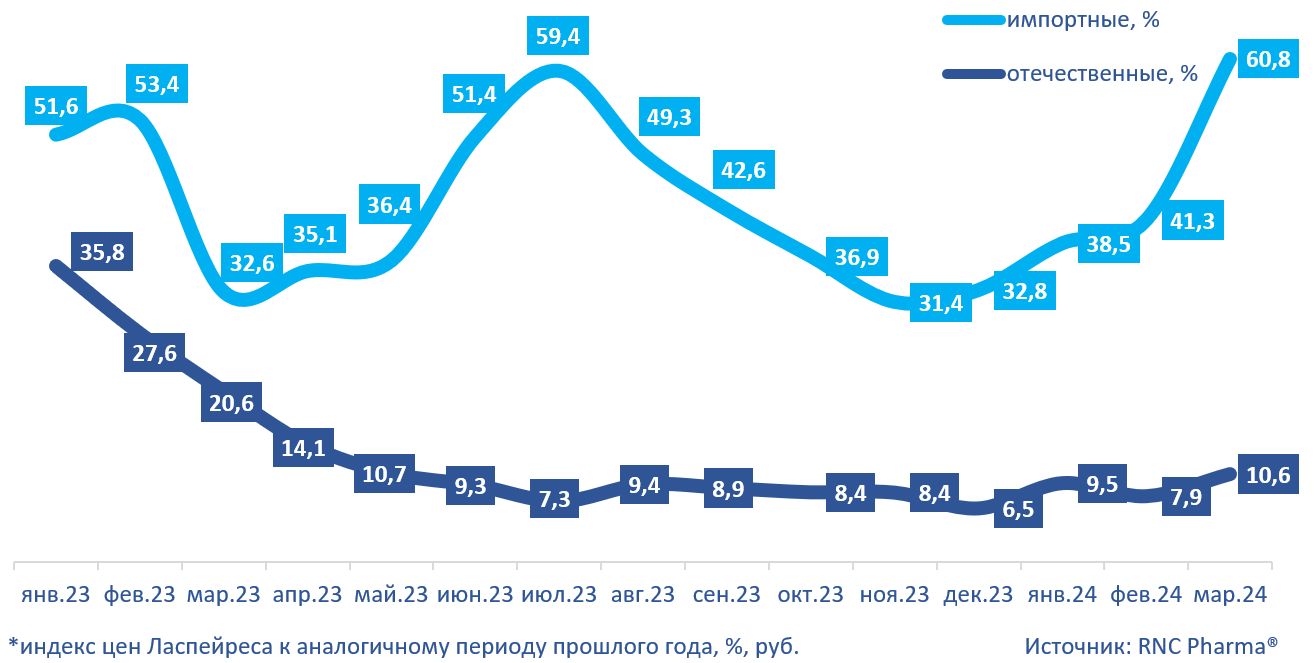

The growth rates of prices for imported and Russian-made drugs differed significantly; the average price for foreign products in 2023 grew 36.6% from 2022, while that for Russian-made goods went up by only 11.6% (Fig. 2). The prices for foreign products went up in the spring and summer; the prices peaked in July at 59.4%. At the same time, the growth rates of prices for imported goods determined the growth rates in the whole market and were heavily influenced by the situation in the foreign exchange market, especially when parallel imports were involved. March 2024 saw the highest inflation rate since January 2023—60.8%. In January–March 2024, the prices for imported veterinary drugs went up 49%.

The inflation rate for Russian-made drugs in 2023 had a clear downward trend. It peaked in January 2023 at 35.8%, reaching a comfortable 10.7% in May 2023 before dropping to its lowest in December 2023 (6.5%). In January 2024, however, the prices started to grow—the inflation rate was 9.5%—before falling to 7.9% in February 2024 and then growing again, to 10.6%. In Q1 2024, the prices for Russian-made veterinary drugs went up 9.3%.

Fig. 2. Inflation rates* in the veterinary retail market in January 2023–March 2024 (imported / Russian-made)

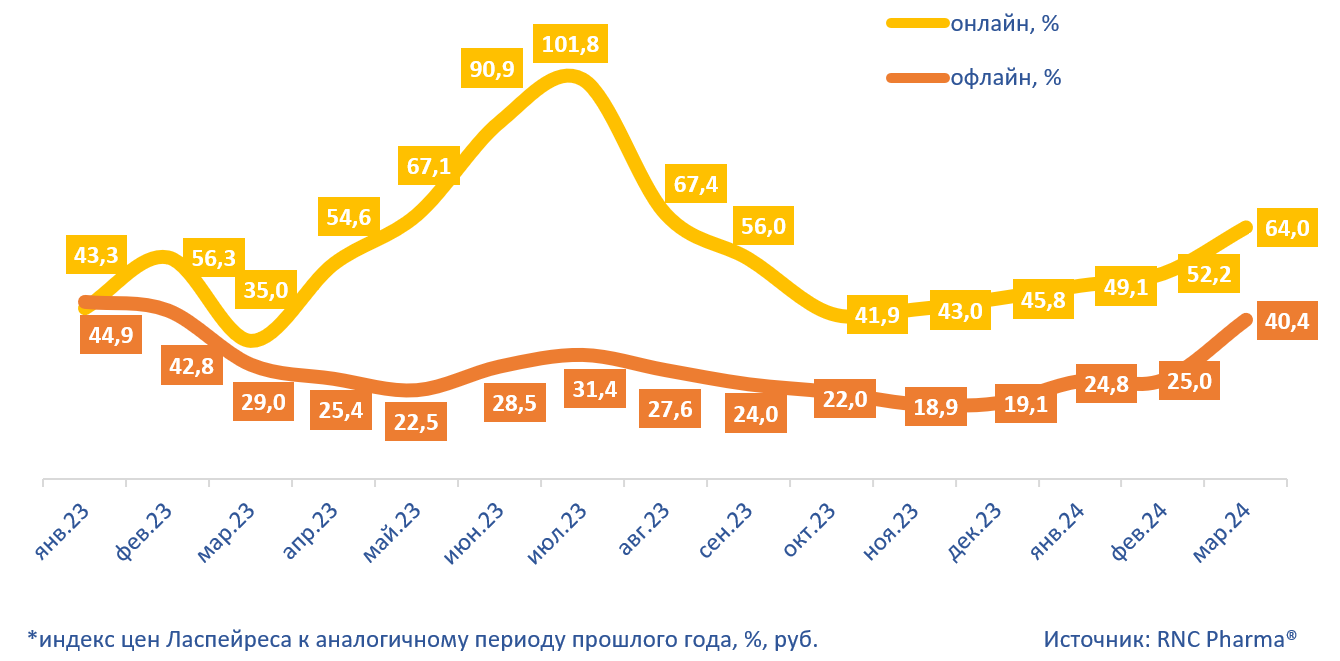

The inflation rate differed greatly from segment to segment in 2023 (Fig. 3). The online prices went up 45% against 23% in the offline segment.

The inflation rate in the offline market was higher than that in the online segment only once, at 44.9% in January 2023. After that, the inflation rate went down, reaching its lowest at 18.9% in November 2023. In December 2023, it went up once again, to 19.1%, and the upward trend continued in 2024—the price index was 40.4% in March 2024. In Q1 2024, the prices went up 32.1%. The inflation rate in the online market was 64% in March 2024 and 55.2% in January–March 2024.

Fig. 3. Inflation rates* in the veterinary retail market in February 2023–March 2024 (online / offline)

Рус

Рус